hahaha well what i can tell you is that i am busy trying to stop my hed spinning. i have completely stuffed myself.

i may not think i had changed my rules that much but i have changed them enough that i have completely lost confidence in what i am doing.

so i am looking at charts, i can see where and what i should be stalking but because my rules have changed it is no longer intuitive and at this timeframe i have stopped dead.

so although that sounds bad, it is probably what i needed as i did want to bring about change, but i think it is going to take much longer than i anticipated.

so..... i got so frustrated a while ago i took AUD long. not sure if it fitted rules or not, will have to go back and check.

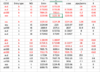

i could see USD index about to break down, could see i should be looking long for aud, gold , gbp by my eye AUD looked best setup.

entered .73202 half position stop now .73183.

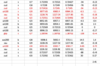

index up oh so gently on uk open but at least up, i feel i should have a long order around 2750 - last hi on us500 but i may just sit here and watch..........

i may not think i had changed my rules that much but i have changed them enough that i have completely lost confidence in what i am doing.

so i am looking at charts, i can see where and what i should be stalking but because my rules have changed it is no longer intuitive and at this timeframe i have stopped dead.

so although that sounds bad, it is probably what i needed as i did want to bring about change, but i think it is going to take much longer than i anticipated.

so..... i got so frustrated a while ago i took AUD long. not sure if it fitted rules or not, will have to go back and check.

i could see USD index about to break down, could see i should be looking long for aud, gold , gbp by my eye AUD looked best setup.

entered .73202 half position stop now .73183.

index up oh so gently on uk open but at least up, i feel i should have a long order around 2750 - last hi on us500 but i may just sit here and watch..........