UMike

Klutzing in Thai

- Joined

- 16 January 2007

- Posts

- 1,436

- Reactions

- 1,755

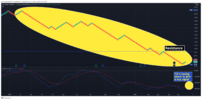

I picked up alot right at the bottom of that knife. Unfortunately I sold most at the first peak.

Starting to accumulate them now in the "averaging down" phase.

For some reason I am not good with the reversal waiting. As with ANZ I bought the knife (~03/2020) but sold into this reversal. Missed out on a big profit.

Starting to accumulate them now in the "averaging down" phase.

For some reason I am not good with the reversal waiting. As with ANZ I bought the knife (~03/2020) but sold into this reversal. Missed out on a big profit.