- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,437

Averaging down is sometimes confused with catching a falling knife, but they are fundamentally different.

Here's a falling knife:

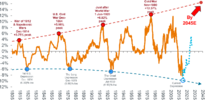

AGL was last at present prices back in 1997.

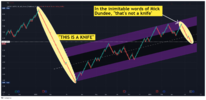

Here's a chart where averaging down might apply:

The simple and clear difference between the two is that AGL has a trending series of lower lows, while EVN has a trend of higher lows.

AGL presently has no redeeming features, while EVN has a pipeline of profitable projects over and above its currently successful operations.

The chances of getting hurt by a falling knife outweigh the odds of success. Best to wait until it has bottomed, and afterwards see if there's a good reason to want to pick it up.

Here's a falling knife:

AGL was last at present prices back in 1997.

Here's a chart where averaging down might apply:

The simple and clear difference between the two is that AGL has a trending series of lower lows, while EVN has a trend of higher lows.

AGL presently has no redeeming features, while EVN has a pipeline of profitable projects over and above its currently successful operations.

The chances of getting hurt by a falling knife outweigh the odds of success. Best to wait until it has bottomed, and afterwards see if there's a good reason to want to pick it up.

Last edited: