The golden trifecta.A smoker, having a beer, playing the pokies has to be the tax man’s wet dream hahaha.

Cashless society

- Thread starter sptrawler

- Start date

-

- Tags

- cash cashless society

greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,528

- Reactions

- 4,693

Doesn‘t the block chain Basically leave a permanent public record of all the transactions that can be traced?

also, because the actually Bitcoin block chain can only process such as small number of transactions each minute, and authentication can take up to 12 minutes, when it comes to daily transactions You are going to have to have a similar setup up to the current credit card system, where a bank or Institution holds the crypto in a “vault” and the transactions are all just processed off the actual block chains, so it will be no different to they was credit cards work now, it’s just the settlement will be in crypto instead of Australian dollars.

Yes, there is a public record of transactions but it's more opaque than an Australian bank account and transactions that are not the subject of an investigation would be reasonably anonymous. It gets more anonymous the less you use the more prominent cryptocurrencies. There are ways and means to get more and more anonymous for most purposes.

Gold and silver bullion is as anonymous as it gets. You will need some cash to obtain it but once you own it its very difficult for anyone to know what you have done with it.

Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,281

- Reactions

- 8,555

you can’t really go down to 7/11 and buy some Krispy Kreme donuts with gold bullion though.Yes, there is a public record of transactions but it's more opaque than an Australian bank account and transactions that are not the subject of an investigation would be reasonably anonymous. It gets more anonymous the less you use the more prominent cryptocurrencies. There are ways and means to get more and more anonymous for most purposes.

Gold and silver bullion is as anonymous as it gets. You will need some cash to obtain it but once you own it it’s very difficult for anyone to know what you have done with it.

Did you understand what I said about crypto not being good for actual real time transactions, and there still being a need to have clearing houses similar to visa/Mastercard and the banks to process the transactions?

for example bitcoin can not handle the large amount of transactions that happen every day, so if you wanted to have Bitcoin as the currency for all transactions, you would have to have basically the equivalent of bank accounts and credit cards dealing with all the transactions, and these institutions just settle in Bitcoin, so all the records of the transactions you made would exist in exactly the same way as they do with regular credit cards now.

- Joined

- 20 July 2021

- Posts

- 13,196

- Reactions

- 18,279

around the area i used to reside i note more than half the shops have erected bollards to stop/slow ram-raiders , including shops i am surprised that have been targeted ( some repeatedlyWhat I mean is that shop owners charge people paying cash a 1% fee to cover the costs of armed guards and other cash handling costs, just like they charge credit card users.

seems cash isn't the big prize in some areas

i mean the pharmacy and bottle shops they are logical but the bakery and a trinket shop( selling a lot of second-hand stuff and craft stuff )

the old shopping centre must look like little Chicago at night now shutters , bollards raised footpath and cameras everywhere

- Joined

- 8 June 2008

- Posts

- 14,049

- Reactions

- 21,138

They are, and they tend to have a limited impact pension cost wise.......A smoker, having a beer, playing the pokies has to be the tax man’s wet dream hahaha.

A Cashless Society creates a greater disadvantage to an already struggling working class, it allows greater profits for banks and an ability for all business to cause an untethered upward pressure on prices (discrimination already exists in disadvantaged suburbs try finding an ATM that is not privately owned ergo costs of withdrawals arise, borrowing becomes near impossible due to automation of application where data is scraped from statements with no face to face explanation or an ability to appeal for customers exists.

Furthermore in cases a cashless society can be a gamification of money (imagine poker machine player tapping away giving no value to money). It also simplifies Cyber fraud both local and international, cyber terrorist attacks by anti democratic adversaries. I suspect much like the GST a cashless society is meant to control the flow of Income for Tax purposes in society and as we know the PAYG employee has been doing their part whilst others find avenues to circumvent the system and will do so in a cashless society.

Perhaps it is time for government to invest in changes to the Tax Act rather than taking away part of the identity of a nation that being its cash.

Furthermore in cases a cashless society can be a gamification of money (imagine poker machine player tapping away giving no value to money). It also simplifies Cyber fraud both local and international, cyber terrorist attacks by anti democratic adversaries. I suspect much like the GST a cashless society is meant to control the flow of Income for Tax purposes in society and as we know the PAYG employee has been doing their part whilst others find avenues to circumvent the system and will do so in a cashless society.

Perhaps it is time for government to invest in changes to the Tax Act rather than taking away part of the identity of a nation that being its cash.

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,706

- Reactions

- 7,042

I’m staying in a remote Tasmanian resort, they charge a surcharge for cards but not for cash.

Why is that?

It’s because the banks profit comes from card transactions. All the talk adding a surcharge is a way to put fear into users and sway them to cards.

Most businesses don’t need a armoured vehicle to transport money, so most businesses don’t have the added cost. As for banking the cash, it’s only a problem for the few lazy managers.

Why is that?

It’s because the banks profit comes from card transactions. All the talk adding a surcharge is a way to put fear into users and sway them to cards.

Most businesses don’t need a armoured vehicle to transport money, so most businesses don’t have the added cost. As for banking the cash, it’s only a problem for the few lazy managers.

Dona Ferentes

Beware of geeks bearing grifts

- Joined

- 11 January 2016

- Posts

- 18,295

- Reactions

- 25,095

*missed CREDIT in your entry.I’m staying in a remote Tasmanian resort, they charge a surcharge for cards but not for cash.

Why is that?

It’s because the banks profit comes from *card transactions. All the talk adding a surcharge is a way to put fear into users and sway them to cards.

.

View attachment 173861

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,706

- Reactions

- 7,042

*missed CREDIT in your entry.

The RBA estimates the average cost of processing different payment methods to be: EFTPOS - less than 0.5 per cent. Visa and Mastercard debit cards - between 0.5 per cent and 1 per cent. Visa and Mastercard credit cards - between 1 per cent and 1.5 per cent.

Being hit with card surcharges everywhere you go? These are the rules around them

While Australia appears to be moving towards becoming a cashless society, more businesses than ever are charging customers a fee to pay with a credit or debit card.

Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,281

- Reactions

- 8,555

I don't agree, I think cashless is a net plus to consumers, thats why more than ever consumers are going cashless, it is also a cheaper system over all to run. Cash is a clunky expensive, and labour intensive system when you really look at it, its like block buster video compared to Netflix.A Cashless Society creates a greater disadvantage to an already struggling working class, it allows greater profits for banks and an ability for all business to cause an untethered upward pressure on prices (discrimination already exists in disadvantaged suburbs try finding an ATM that is not privately owned ergo costs of withdrawals arise, borrowing becomes near impossible due to automation of application where data is scraped from statements with no face to face explanation or an ability to appeal for customers exists.

Furthermore in cases a cashless society can be a gamification of money (imagine poker machine player tapping away giving no value to money). It also simplifies Cyber fraud both local and international, cyber terrorist attacks by anti democratic adversaries. I suspect much like the GST a cashless society is meant to control the flow of Income for Tax purposes in society and as we know the PAYG employee has been doing their part whilst others find avenues to circumvent the system and will do so in a cashless society.

Perhaps it is time for government to invest in changes to the Tax Act rather than taking away part of the identity of a nation that being its cash.

And what is wrong with banks making more money if they are offering consumers a better product, and most of the working class own the banks in their super funds any way.

Actually NO at some businesses ALL EFTPOS transactions incur a fee, to top it off more often than not the nearby ATM is not working (personal experience), not because of being a tighty but rather for FSake it is my money why charge a fee given that you give me little interest (costs what costs no branches, long queues and almost completely automated,) while the bank makes margin. It is not only banks most businesses in retail or services are making greater profit margins than before Covid.*missed CREDIT in your entry.

Unfortunately consumer apathy continues to allow the unreasonable, unrestrained growth of business margins, while we have a personal positive income/expense sheet it's all good fun until, uh oh....

Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,281

- Reactions

- 8,555

Don't be mad at the bank for the card fee, be mad at the shop, they are the one passing along a cost to you that they should just really be absorbing, since they absorb the cash handling costs when you spend cash.Actually NO at some businesses ALL EFTPOS transactions incur a fee, to top it off more often than not the nearby ATM is not working (personal experience), not because of being a tighty but rather for FSake it is my money why charge a fee given that you give me little interest (costs what costs no branches, long queues and almost completely automated,) while the bank makes margin. It is not only banks most businesses in retail or services are making greater profit margins than before Covid.

Unfortunately consumer apathy continues to allow the unreasonable, unrestrained growth of business margins, while we have a personal positive income/expense sheet it's all good fun until, uh oh....

Whether you make your payment with cash or card, the business incurs some cash handling costs, but they generally only pass on the card costs, because they see them on their statement, where as some of the cash handling costs are more hidden from them eg their time of doing bank runs, getting change etc etc

So if the card costs being passed along makes you mad, be mad at the business and wonder why they let the cash users spend cash for free but not your card transaction, Most big businesses don't pass on card fees because they know its cheaper for them than paying armed guards etc, its only the small unsophisticated business owners that pass along the charges, because they don't value their time correctly or want cash because they want to dodge tax.

I’m not mad at banks at all but rather attempting to point out the APATHY that exists increasingly in our society by consumers and that we seem to be showing little regard to the impact of what may seem to many as minor (won’t effect me) business actions including that of going cashless.Don't be mad at the bank for the card fee, be mad at the shop, they are the one passing along a cost to you that they should just really be absorbing, since they absorb the cash handling costs when you spend cash.

Whether you make your payment with cash or card, the business incurs some cash handling costs, but they generally only pass on the card costs, because they see them on their statement, where as some of the cash handling costs are more hidden from them eg their time of doing bank runs, getting change etc etc

So if the card costs being passed along makes you mad, be mad at the business and wonder why they let the cash users spend cash for free but not your card transaction, Most big businesses don't pass on card fees because they know its cheaper for them than paying armed guards etc, its only the small unsophisticated business owners that pass along the charges, because they don't value their time correctly or want cash because they want to dodge tax.

In my work experience I see unfair decisions/changes that may cause hardship being placed upon certain suburbs and demographics. I agree EFTPOS fees ought be and in my business experience have always been added to the calculation of costs prior to assessing a Selling Price, seems retailers ought be calling it the sucker fee.

It seems to me greed has taken control of retail sales these days, many of us can point to outrageous cost blowouts that defy logic including price increases at the large grocery chains counter, their margins grow as they suggest to us petty theft is on the rise in their stores (they increase costs, margins and profit under the pretext they are being robbed…lol) nonetheless we carry on by affirming to our own suspicions “it’s only $3“ however for many $3 can be a godsend. My point is be aware of our own apathy and perhaps add a little empathy into your wealth growing day. (Probably not the place for this spiel… done now…

Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,281

- Reactions

- 8,555

I don’t think going cashless is caused by consumer apathy, I think most consumers love it and prefer it. I certainly prefer cashless transactions.I’m not mad at banks at all but rather attempting to point out the APATHY that exists increasingly in our society by consumers and that we seem to be showing little regard to the impact of what may seem to many as minor (won’t effect me) business actions including that of going cashless.

In my work experience I see unfair decisions/changes that may cause hardship being placed upon certain suburbs and demographics. I agree EFTPOS fees ought be and in my business experience have always been added to the calculation of costs prior to assessing a Selling Price, seems retailers ought be calling it the sucker fee.

It seems to me greed has taken control of retail sales these days, many of us can point to outrageous cost blowouts that defy logic including price increases at the large grocery chains counter, their margins grow as they suggest to us petty theft is on the rise in their stores (they increase costs, margins and profit under the pretext they are being robbed…lol) nonetheless we carry on by affirming to our own suspicions “it’s only $3“ however for many $3 can be a godsend. My point is be aware of our own apathy and perhaps add a little empathy into your wealth growing day. (Probably not the place for this spiel… done now…)

getting rid of the need for me to think about withdrawing cash, and dealing with change etc etc is a plus in my life.

when I was in business I preferred card payments, I even put up big signs saying I except American Express, even though that was the most expensive card at 3%, but card holders loved it, and I gained market share over a local competitor who charged American Express holders a fee, god only knows why when in our industry we had 50% gross profit margins, losing $300 of gross profit because you don’t want a $9 fee is silly, especially because he also had a buy 5 get one free deal which costs more than 3%

Dona Ferentes

Beware of geeks bearing grifts

- Joined

- 11 January 2016

- Posts

- 18,295

- Reactions

- 25,095

was replying to John D, concerning the specific circumstances; he postedActually NO at some businesses ALL EFTPOS transactions incur a fee, to top it off more often than not the nearby ATM is not working (personal experience), not because of being a tighty but rather for FSake it ....

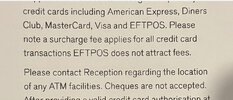

which to my understanding states that EFTPOS does not attract fees.

I don't agree, I think cashless is a net plus to consumers, thats why more than ever consumers are going cashless, it is also a cheaper system over all to run. Cash is a clunky expensive, and labour intensive system when you really look at it, its like block buster video compared to Netflix.

And what is wrong with banks making more money if they are offering consumers a better product, and most of the working class own the banks in their super funds any way.

I was at Service NSW to renew my Driver’s License, I decided to pay my fee by way of Eftpos using my debit card (not a credit card, my wife likes me to use it for the loyalty points, another inflationary transaction but I digress she who must be obeyed always winswas replying to John D, concerning the specific circumstances; he posted

View attachment 173891

which to my understanding states that EFTPOS does not attract fees.

Not sure why this was the case nonetheless it is frustrating to see why this type of penny pinching needs to occur everywhere, not everyone is aware of these options, daily simple transactions ought not be an avenue for padding profits clarity should be availed to all consumers.

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,706

- Reactions

- 7,042

I don’t understand why some people keep pointing fingers at cash transactions, trying to manipulate society into believing that using cash is dirty and the vice of tax cheating men and women.

When the biggest money cheats are usually big corporations that don’t use cash but lose millions of dollars of electronic funds. And they have lawyers and accountants that help declare bankruptcy, only to return and start again.

For every person convicted, how many pay back the losses with assets squirrelled away?

When the biggest money cheats are usually big corporations that don’t use cash but lose millions of dollars of electronic funds. And they have lawyers and accountants that help declare bankruptcy, only to return and start again.

For every person convicted, how many pay back the losses with assets squirrelled away?

Apricity Finance boss Linden Toll arrested on fraud charges

Linden Toll, the managing director of Apricity Finance which collapsed a year ago with debts of more than $50m, has been charged with several criminal offences relating to an “alleged multimillion-dollar fraud’’.

New South Wales Police last week extradited Mr Toll, 55, from Queensland, having been granted an arrest warrant on March 13.

“Detectives attached to The Hume Police District initiated an investigation into the alleged multimillion-dollar fraud relating to loans and investment companies in the Southern Highlands between 2013 and 2023,’’ NSW Police said in a statement.

Mr Toll was last week charged with three counts of publishing fake or misleading material to obtain an advantage, three counts of an officer publishing a false or misleading statement to deceive, dishonestly obtaining financial advantage by deception and knowingly dealing with the proceeds of crime.

greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,528

- Reactions

- 4,693

you can’t really go down to 7/11 and buy some Krispy Kreme donuts with gold bullion though.

Did you understand what I said about crypto not being good for actual real time transactions, and there still being a need to have clearing houses similar to visa/Mastercard and the banks to process the transactions?

for example bitcoin can not handle the large amount of transactions that happen every day, so if you wanted to have Bitcoin as the currency for all transactions, you would have to have basically the equivalent of bank accounts and credit cards dealing with all the transactions, and these institutions just settle in Bitcoin, so all the records of the transactions you made would exist in exactly the same way as they do with regular credit cards now.

I don't care if the bank is aware of day to day transactions at supermarkets, cafes, paying bills, ordinary things like that. But I want the option to engage in consensual momentary transactions with other private citizens that companies or the government are not aware of. I want to retain this right because I do not trust the government or banks. Everything I do is not the business of the government or any company, public or private. These entities are not my family or my friends and I do not want them to know any more about me, or my life, than is absolutely necessary.

If I was to use crypto, I would not use Bitcoin, nor would I use an Australian based crypto broker. I would do my research and transact in such a way as to not be traceable by any Australian-based entity, private or governmental. i accept that any transactions that may be subject to a police investigation could be traced and would not be anonymous. However, it is not my intention to act illegally. All I want to retain is my privacy.

It is worth pointing out that during the COVID-19 pandemic, many of the rights we take for granted were suspended by the government and we essentially became a police state for a period of time. It is clear to me that this could happen again as we have no constitutional protection from the government or the police that can't be dispensed with by the courts. Authoritarianism is only ever one day away. If we take only one thing away from the COVID-19 experience that should be it.

Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,281

- Reactions

- 8,555

Well, you do you I guessI don't care if the bank is aware of day to day transactions at supermarkets, cafes, paying bills, ordinary things like that. But I want the option to engage in consensual momentary transactions with other private citizens that companies or the government are not aware of. I want to retain this right because I do not trust the government or banks. Everything I do is not the business of the government or any company, public or private. These entities are not my family or my friends and I do not want them to know any more about me, or my life, than is absolutely necessary.

If I was to use crypto, I would not use Bitcoin, nor would I use an Australian based crypto broker. I would do my research and transact in such a way as to not be traceable by any Australian-based entity, private or governmental. i accept that any transactions that may be subject to a police investigation could be traced and would not be anonymous. However, it is not my intention to act illegally. All I want to retain is my privacy.

It is worth pointing out that during the COVID-19 pandemic, many of the rights we take for granted were suspended by the government and we essentially became a police state for a period of time. It is clear to me that this could happen again as we have no constitutional protection from the government or the police that can't be dispensed with by the courts. Authoritarianism is only ever one day away. If we take only one thing away from the COVID-19 experience that should be it.

I just focus on making money.

Similar threads

- Replies

- 14

- Views

- 1K