- Joined

- 28 August 2022

- Posts

- 8,159

- Reactions

- 13,528

both at the momentHope you get better.

Is the body or the spirit low?

In either case, rest!

both at the momentHope you get better.

Is the body or the spirit low?

In either case, rest!

@JohnDe Sir this post brought a lump to my throat and it isn't the gunge I am tryig to expel from the lungs.my parish church has two offerings during the mass, with the ancient wooden bowls handed down each isle for donations. The first is to help the poor and disadvantaged, the second for maintenance funds for the old and beautiful church building.

I always put a $20 or $50 in each, but I see everything in it from 20c and up. People give what they can. There is also an eftpos machine at the front, showing that the church is keeping up with the current trend.

We recently had my father’s 1 year Mass, it’s customary to offer a donation to the church. My parents were married in the church, all their children were baptised in the same church, my wife and I married in it, and our children baptised and confirmed in it. I have been to the funerals of my Grandparents, Aunts and Uncles in the church building. So when I gave my donation I gave it in cash for everyone of my family that have passed and loved the church.

I asked the priest about the cash and cashless question, and he said ‘the world is not black and white, there are many shades which make it beautiful. There are many in society that are vulnerable and need help, that includes people that have difficulty with a digital world. Be that because they are homeless, have addictions or are unable to fully comprehend, it doesn’t matter. All that matters is that we do not forget them.’

The homeless people I see in the streets don’t carry a eftpos machine. I don’t give to all of them, if they’re drunk or drugged I walk by, but if it looks like they are trying I give them 5 or 10$.

Can’t do that in a cashless world.

as an ex-MYR holder ..Not really CC fee/charge related but it is Christmas -

Our extended family holds a Secret Santa every Christmas - last year it was maximum $50. I drew one of my Granddaughters. Her wish was for a $50 Myer Card and so that she could shop there on Boxing Day.

Off to Myer service desk - they wanted $5 for the card plus the $50 credit. No thanks!

Back home I used the pc to download a copy of the Myer card - printed same and added $50 note to the gift envelope.

Everyone happy except Myer who may or may not have received the $50 on Boxing Day.

@JohnDe And I would imagine that 1.5% would add up to a reasonable amount after 5 days.The hotel I’m staying at for 5 days charges 1.5% for credit cards.

I won’t be using my card.

View attachment 190271

chment

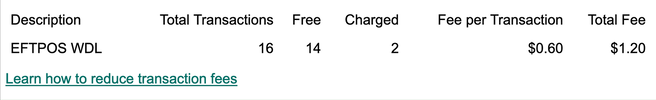

chmentJust more sneaky charges from the thieving banks.Another cheeky charge - Wife's Suncorp Everyday Options Card Acc. used purely as a debit card. She asked me what a recent transaction fee was all about. I checked and found that she is entitled to 14 EFTPOS transactions per month before the bank decides to bring the wallet extraction pliers into action.

60 cents per additional use of the card during that month.

View attachment 190330chment

I have advised her to take out more cash at Woolies/Aldi from now on and to pay cash for her coffees/theatre tickets etc.

We are in the thros of transitioning all of our banking from BankWest to the Commonwealth.Wife's card got hacked she must have used a skimmer somewhere or Commonwealth bank was hacked. Now has to wait up to 50 days to get her money back. Commonwealth has been hit a few times if it's on their end again.

She had all the cards security features turned on bar the stop all transactions.

is that just for withdrawing cash eg cash out?Another cheeky charge - Wife's Suncorp Everyday Options Card Acc. used purely as a debit card. She asked me what a recent transaction fee was all about. I checked and found that she is entitled to 14 EFTPOS transactions per month before the bank decides to bring the wallet extraction pliers into action.

60 cents per additional use of the card during that month.

View attachment 190330chment

I have advised her to take out more cash at Woolies/Aldi from now on and to pay cash for her coffees/theatre tickets etc.

Tell her to avoid inserting the card and just tap, or even better use load her card details on to her phone and use Apple Pay.Wife's card got hacked she must have used a skimmer somewhere or Commonwealth bank was hacked. Now has to wait up to 50 days to get her money back. Commonwealth has been hit a few times if it's on their end again.

She had all the cards security features turned on bar the stop all transactions.

Trying to work out how they got the details. She's been hit about 3 times over the past 8ish years. 2 were from data breeches one involving commonwealth bank. There's a few new skimmers out there and payID is getting compromised. Could be malware on the phone.Tell her to avoid inserting the card and just tap, or even better use load her card details on to her phone and use Apple Pay.

with Apple Pay you credit card details don’t actually leave your phone, it uses a secondary card number that it generates and links to that device, and it only works if that device is using it, and it needs to scan your face at the same time.Trying to work out how they got the details. She's been hit about 3 times over the past 8ish years. 2 were from data breeches one involving commonwealth bank. There's a few new skimmers out there and payID is getting compromised. Could be malware on the phone.

Or hacked website.

Commonwealth bank gets hit a lot I've been hit a few times with Commonwealth and zero times from ANZ, maybe once with westpac. I check machines if i use them and dont use the card otherwise (dont tap or insert). So commonwealth has a problem.

Tap and go can be hit via relay attacks. Need two people.

One gets close to you and transmits your rfid to a second person who can now tap and go.

Apple pay in theory could be compromised in the same way but it would have to be scanned as a person was paying with their Apple phone and the 2nd scammer would have to pay at the same time.

One of the safer methods is to have two accounts and just put in what you intend to spend into the debit card account from the account with the bulk of your money.

Or just pay cash everywhere.

All 16 transactions were eftpos debit purchases at either Aldi/Coles or for coffees, movies, etc. The account only allows 14 per month - every extra transaction incurs a 60 cents fee. Wife now pulls out extra cash with those purchases to avoid fees when paying for minor items.is that just for withdrawing cash eg cash out?

If that is just regular transactions it is obviously not the correct account, for what she wants to use it for.

But out of interest, if $1.20 per month saved you a trip to an atm, that would be money well spent in my opinion.

Might be the option. I need a new phone but was holding out as the chip technology is moving so fast. I'm simply not a fan of Apple phones. But some of the features such as the Apple pay and phone security are appealing.with Apple Pay you credit card details don’t actually leave your phone, it uses a secondary card number that it generates and links to that device, and it only works if that device is using it, and it needs to scan your face at the same time.

Apple Pay is the safest way to pay.

I am travelling in the USA at the moment and have used Apple Pay the whole time, I also used it all through Europe.

For Me and She mobile phones are evil necessity for our business, but I would much rather revert to smoke signals.Might be the option. I need a new phone but was holding out as the chip technology is moving so fast. I'm simply not a fan of Apple phones. But some of the features such as the Apple pay and phone security are appealing.

I suppose I can just buy 2 phones. Actually I probably should have just done that in the first place.

Yeah there are definitely better accounts, that offer unlimited free transactions, probably call your bank and see what they suggest.All 16 transactions were eftpos debit purchases at either Aldi/Coles or for coffees, movies, etc. The account only allows 14 per month - every extra transaction incurs a 60 cents fee. Wife now pulls out extra cash with those purchases to avoid fees when paying for minor items.

I have the same type of account and most of my transactions are cash withdrawals from local Suncorp approved ATMs - seems to be no charge for these. I use a credit card for purchase of major items, cash for minor eg. coffee, haircut, grandkids' pocket money. etc.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.