Craton

Mostly passive, contrarian.

- Joined

- 6 February 2013

- Posts

- 1,743

- Reactions

- 2,490

Looking for a bump up on any positive BNC210 announcement.

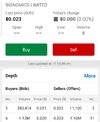

So far market has reacted only by -10 %. Should have believed on my own judgement and exited. Time is money and goes either way.Good that market opens at the same level of closing price of yesterday. Very interesting indeed.

Let us hope it stays like that.

Bionomics Limited (ASX:BNO, OTCQX:BNOEF), a global, clinical stage biopharmaceutical company leveraging proprietary platform technologies to discover and develop a deep pipeline of novel drug candidates targeting ion channels, is pleased to announce positive feedback from the FDA at the recent Type C meeting to discuss BNC210 for the treatment of Post-Traumatic Stress Disorder (PTSD). The objective of the meeting was to seek guidance on the plans for further development of BNC210 in a second Phase 2 trial in PTSD patients using the newly developed tablet formulation and aiming for the exposure levels predicted from the pharmacometric analyses to have potential for clinical benefit. The FDA was supportive of the approaches outlined by Bionomics.

Furthermore, following discussions with the FDA, Bionomics has submitted an application for Fast Track designation for BNC210 for the treatment of PTSD. Fast Track is a process designed to facilitate the development and expedite the review of drugs to treat serious conditions and fill an unmet medical need. The application outlines the non-clinical and clinical data for BNC210 showing efficacy in animal models representing symptoms of PTSD, such as anxiety, hyperarousal and fear extinction, and an improved clinical and non-clinical safety and tolerability profile compared to the standard of care therapies for PTSD which are the SSRIs, sertraline and paroxetine.

At the same time, Bionomics is completing a single ascending dose pharmacokinetic study in healthy volunteers to demonstrate that blood levels of BNC210, predicted to be necessary to meet the primary efficacy endpoints in any further trials in PTSD patients, are achievable using the new solid dose formulation. The results of this trial are expected in October 2019.

Bionomics Limited (ASX:BNO, OTCQX:BNOEF), a global, clinical stage biopharmaceutical company discovering and developing a deep pipeline of novel drug candidates targeting ion channels, is pleased to announce positive results from a pharmacokinetic study in healthy volunteers using the newly developed solid dose formulation of Bionomics' lead drug candidate, BNC210.

The study demonstrates that the solid dose of BNC210 achieves the blood levels predicted as necessary to meet the primary endpoints for effectiveness for treating Post-Traumatic Stress Disorder (PTSD) patients in future clinical trials.

The study is the culmination of efforts designed to overcome the failure of the liquid suspension formulation to provide sufficient blood exposure for efficacy in the Phase 2 PTSD trial, RESTORE, that read out in October 2018.As reported on 18 February 2019, the liquid suspension formulation of BNC210 used in the RESTORE trial was required to be taken with food, gave variable absorption and consequently lower exposure than expected. However, a pharmacometric analysis of the PTSD trial data showed an exposure-response relationship (between BNC210 blood levels and CAPS-5 scores, the primary endpoint measure in PTSD trials),and the potential of BNC210 to treat PTSD symptoms provided that adequate blood levels couldbe achieved(Area Under the Curve or AUC ~25 mg.h/L).

These new pharmacokinetic data from the single ascending doses of BNC210, along with data reported earlier this year demonstrating that the solid dose formulation can overcome the “food effect”,show that the solid dose formulation of BNC210 can reach blood levels required to achieve exposures predicted to give clinically meaningful and statistically significant changes from placebo on Total CAPS-5 scores (Table 1). The plasma concentrations and exposures measured in fasted healthy volunteers also increased in a dose proportional manner, demonstrating improved dose linearity with the solid dose formulation compared to the liquid suspension (Figure 1).

BNC210 was well tolerated at the exposure levels reached in the healthy volunteers in this study.

Bionomics recently attended a supportive Type C meeting with the FDA to discuss the further development of BNC210 using the solid dose formulation for the treatment of PTSD and subsequently submitted a request for Fast Track designation for BNC210.

The results of this pharmacokinetic clinical trial show that the new solid dose formulation achieves the targeted blood levels to support further development of BNC210 for the treatment of PTSD.

Thread carefully with health start up (researches). Had 99% skin burnt with this type of stocks for too many years to mention. An example, Only yesterday, I read somewhere that AT1 sp had shot up. Bring back all my sad memories, watching my hard earned went down the sink hole. Had owned AT1 from day 1 until 3yrs ago, had to bite the bullet and let it died.Up She, He, It pops... surely these are just idioms?

Good call Miner.

I see this as one of the closely followed and very volatile stocks that are worth the investment (cough, read punt) on the cycle. Always easy to say in low, out high but for me, this has been a great training stock as I don't have a preconceived holding strategy i.e. short, mid, long term. It's purely for trading when the opportunity presents.

... enjoy it while it lasts, miner.I was initially thrilled to see my tip at the second top on the second day of trading.

However on a detailed look, I was shocked to see how could one single trade has hijacked the closing price indicator

I do like to rise on the tip ladde, with conviction but never on a gain of one trade to equate the way Aussies made the English cricketer out. Both are legal but to me both were unfair.

So I will wait to see what Wednesday and onwards days trades are looking like

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.