- Joined

- 8 June 2008

- Posts

- 13,398

- Reactions

- 19,825

I sold out of most of my crypto yesterday..took my profit and just kept .1 BTC from memory....

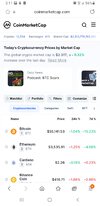

and just saw BTC already up 49k USD...ah well US share market is crashing so may not keep up that long?

and just saw BTC already up 49k USD...ah well US share market is crashing so may not keep up that long?