- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,308

Follow up from here...

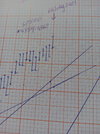

BHP EW Pattern

It's hit the first target level and looking like it will continue imo.

(click to expand)

BHP EW Pattern

It's hit the first target level and looking like it will continue imo.

(click to expand)