BHP - BHP Group

- Thread starter still_in_school

- Start date

-

- Tags

- bhp bhp billiton bhp group

- Joined

- 2 June 2011

- Posts

- 5,341

- Reactions

- 242

Hi all,

I just started investing last week, and the stock I picked is BHP at $39.

However recent price drops sharply.

What do you guys think after the departure of CEO?

Should I try hold for a while or just sell it to avoid further loss?

What was the reason you bought in the first place? If you can't answer that question then you should never have bought in. If you can answer it then consider whether that criteria has changed in the last week (unlikely!).

Kloppers was no genius, so his departure is much of a muchness, to me anyway.

What was the reason you bought in the first place? If you can't answer that question then you should never have bought in. If you can answer it then consider whether that criteria has changed in the last week (unlikely!).

Kloppers was no genius, so his departure is much of a muchness, to me anyway.

Yes i admitted i just read a research report saying that intrinsic value should be $50 and then made decision..

What kind of research did you do when deciding to invest?

- Joined

- 22 November 2010

- Posts

- 3,661

- Reactions

- 11

Yes i admitted i just read a research report saying that intrinsic value should be $50 and then made decision..

What kind of research did you do when deciding to invest?

Did this report have a disclaimer so big, you could drive a Mack truck through it?

Who remembers Ravensthorpe?

http://en.wikipedia.org/wiki/Ravensthorpe_Nickel_Mine

- Joined

- 2 June 2011

- Posts

- 5,341

- Reactions

- 242

What kind of research did you do when deciding to invest?

Depends. If I'm planning to hold it medium/long term then I want to understand the business, the industry it operates in, it's historic margins (and I'm talking at least 5 years and better if it's 10 years) the likelihood of any recurring revenue, the capital intensity of the business and so on and so forth. At the end of all that, I try and come up with a ballpark value based on free cash flow and then buy when it's well below that.

If you're buying on the say so of a broker report you read last week, then assuming the broker is right (and this is a big assumption), you cannot possibly expect it to run up to $50 in a couple of weeks. It might take 3 months, it might take 3 years. In the interim the price may fall to $20 or lower. It's much easier to hold through that price decline when you have your own opinion, rather than someone else's.

chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

Some great fundamental analysis on this page.

From a technical perspective, BHP needs to get a run from this point, as there is a fair bit of support around 35.

So I agree with GG.

However, I'm not sure there is much motivation for it to run, with the outlook.

I bought this stock as a bottom draw job some years ago.

But their outlook tells me that they're planning on bunkering down, and limiting losses, rather than increasing earnings.

So I can't see much growth potential here, and will cash out if support looks shaky or it meanders for too much longer.

I think there will be more opportunities down the road for this one. IMO.

From a technical perspective, BHP needs to get a run from this point, as there is a fair bit of support around 35.

So I agree with GG.

However, I'm not sure there is much motivation for it to run, with the outlook.

I bought this stock as a bottom draw job some years ago.

But their outlook tells me that they're planning on bunkering down, and limiting losses, rather than increasing earnings.

So I can't see much growth potential here, and will cash out if support looks shaky or it meanders for too much longer.

I think there will be more opportunities down the road for this one. IMO.

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,228

I reckon BHP and FMG look like buys if the close today is around 35.93 or higher (and 4.45 for FMG). Very short term play - 1-2 days.

- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 395

There seemed to be some kind of sentiment shift at just after 11 yesterday.

Many of the Iron ore stops reversed from their down moves and headed up quite aggresively.

I assumed there was something said in the China meeting or something to be said.

Ore was down the night before so it certainly wasn't the driver.

It would be great if it coincides with a shift from high yield to growth.

National Development and reform commission of China have accused the Iron Ore suppliers of convoluting a supply shortage to lift the prices. What a load of crap.

China were the ones who turned off all their furnaces and down ramped the prices by destocking, then when they have a bit of a supply issue they accuse the big 3.

Their shocking.

BHP have responded by transparently showing the FACTS of their supply line over that time. There is nothing manipulated about it!

China manipulates what every it can as soon as it can.

When China's complaining about the price that's a bullish signal!

Hope the Ore price goes to $220

Many of the Iron ore stops reversed from their down moves and headed up quite aggresively.

I assumed there was something said in the China meeting or something to be said.

Ore was down the night before so it certainly wasn't the driver.

It would be great if it coincides with a shift from high yield to growth.

National Development and reform commission of China have accused the Iron Ore suppliers of convoluting a supply shortage to lift the prices. What a load of crap.

China were the ones who turned off all their furnaces and down ramped the prices by destocking, then when they have a bit of a supply issue they accuse the big 3.

Their shocking.

BHP have responded by transparently showing the FACTS of their supply line over that time. There is nothing manipulated about it!

China manipulates what every it can as soon as it can.

When China's complaining about the price that's a bullish signal!

Hope the Ore price goes to $220

- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 395

The Chinese looked rather stupid trying to accuse BHP of price manipulation.

So they have now leaked information to Ausi Feds about BHP bribes.

The Chinese will not allow you to do business without bribes!!!

They then use that to gain leverage in times like these so they can arrest anyone or use them to infiltrate businesses by threatening them and their families if you do not co operate.

So they have now leaked information to Ausi Feds about BHP bribes.

The Chinese will not allow you to do business without bribes!!!

They then use that to gain leverage in times like these so they can arrest anyone or use them to infiltrate businesses by threatening them and their families if you do not co operate.

The sales director for a supplier to Beijing Foton Daimler Automotive is close to despair. She has been selling parts for 20 years but now, she said, more people than ever needed to be bribed to guarantee orders.

"In the past, we would give a purchasing manager a red envelope. But now even assembly line workers will call me threatening that if we don't pay up they will find some problem with our product," she said, asking to remain anonymous for fear of the potential consequences. "The rot has reached the roots."

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,228

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,228

I don't like it today. Just sold.

Maybe around the low 33 mark.

Maybe around the low 33 mark.

nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

In less than two (2) months BHP has fallen from the recent high of $39.00 through two (2) support levels and is now close to testing the low price of $30.18 of July 2022.

While the present Iron ore price is good, gold miners are getting belted following on from the recent gold price sell down by the big banks and others. Oddly enough the demand for physical gold is still high, you'd think the big miners with the lower production costs (and probably some hedging) would weather this sort of fluctuation better.

I don't know, which is why I am asking, is it a good time to buy BHP?

While the present Iron ore price is good, gold miners are getting belted following on from the recent gold price sell down by the big banks and others. Oddly enough the demand for physical gold is still high, you'd think the big miners with the lower production costs (and probably some hedging) would weather this sort of fluctuation better.

I don't know, which is why I am asking, is it a good time to buy BHP?

- Joined

- 4 April 2013

- Posts

- 81

- Reactions

- 0

Time to wait and hold see which way bhp goes before entry.

Trend is down..

Trend is down..

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,228

A few of the bigger resource co's are forming inverted H&S. If they don't break out to the upside within 2-3 weeks, it would be very bearish for the whole sector, imo. Certainly not time to buy, just watch.

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,228

A few of the bigger resource co's are forming inverted H&S. If they don't break out to the upside within 2-3 weeks, it would be very bearish for the whole sector, imo. Certainly not time to buy, just watch.

They all gapped over the neckline. Now a retrace to neckline I guess.

tinhat

Pocket Calculator Operator

- Joined

- 1 May 2009

- Posts

- 1,756

- Reactions

- 769

A couple of interesting things from Andrew Mackenzie's presentation slides that caught my attention:

Slide 7 quantifies BHPs resource base on a copper equivalent basis - equivalent to 1,200 million tonnes of copper based on 2012 prices. I found that a rather interesting way to express their resource base. Has anyone seen this done before? Is this some sort of accounting trickery or are we going to start receiving our dividends in copper?

Earlier in this thread we looked at how a change to the price of iron ore impacts on BHP's profit. Here is an interesting table of impacts to the bottom line. Note they estimate that a 1c move in the AUD impacts the bottom line by US$110 million, the same as a move of US$1/t in the iron ore price.

Is my maths right here? Assuming all else being equal, if the AUD falls from 1.05/1 (USD/AUD) to 0.95/1 then BHPs profit increases by US$1.1b, which when converted into AUD is an increase of $1.1b * 1.1 = AU$1.21b

Slide 7 quantifies BHPs resource base on a copper equivalent basis - equivalent to 1,200 million tonnes of copper based on 2012 prices. I found that a rather interesting way to express their resource base. Has anyone seen this done before? Is this some sort of accounting trickery or are we going to start receiving our dividends in copper?

Earlier in this thread we looked at how a change to the price of iron ore impacts on BHP's profit. Here is an interesting table of impacts to the bottom line. Note they estimate that a 1c move in the AUD impacts the bottom line by US$110 million, the same as a move of US$1/t in the iron ore price.

Is my maths right here? Assuming all else being equal, if the AUD falls from 1.05/1 (USD/AUD) to 0.95/1 then BHPs profit increases by US$1.1b, which when converted into AUD is an increase of $1.1b * 1.1 = AU$1.21b

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 14,438

- Reactions

- 11,993

Thanks tinhat,

I try to stay away from fundamental stuff but agree.

I am bullish on BHP and probably entering early next week.

BHP are masters of Special Dividends.

gg

I try to stay away from fundamental stuff but agree.

I am bullish on BHP and probably entering early next week.

BHP are masters of Special Dividends.

gg

CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

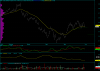

Here's one for bears and pattern fans.....

Curious to see is if works out or not.

I think i might make a wager on it

CanOz

Hi CanOz

I am a bit dense - would you mind explaining what you are signalling here? I assume you are signalling the trend is now positive and might break out to the upside?

Thanks!!