- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

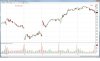

Interesting to see BHP turned around so quickly at resistance. $38 has been a line in the sand for a while now.

All indexes and sub-indexes still looking relatively healthy overall though so I don't think it's time to panic just yet.

Also a little bit of buying support through out the day today with the Australia Day gap continuing to be well defended.

All indexes and sub-indexes still looking relatively healthy overall though so I don't think it's time to panic just yet.

Also a little bit of buying support through out the day today with the Australia Day gap continuing to be well defended.