- Joined

- 6 November 2005

- Posts

- 915

- Reactions

- 0

Warning: ..... astrostuff ahead:

Hi Michael,

AZA ..... as requested, here's a brief overview of anticipated

time cycles over the coming months .....

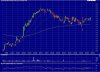

May run up, to have a look at previous high, around 1.40,

but so far the rally has been made on decreasing volume,

so it may not last too long ..... ???

Some key dates for AZA may be:

22032006 ..... negative spotlight on AZA ... a high???

07042006 ..... minor changes ..... finance-related???

14-18042006 ..... 2 significant and negative cycles here???

21042006 ..... minor management changes???

05-08052006 ..... 2 significant and negative cycles here

..... finance-related ???

19-23052006 ..... significant and positive news from

2 time cycles here.

31052006 ..... changes in finances ???

05-06062006 ..... 3 time cycles here ..... negative news of

long-term changes, tempered by a mild positive cycle, late

on 06062006 ???

22-23062006 ..... significant and negative sentiment

26062006 ..... positive financial news???

3006-03072006 ..... minor and positive news ???

-----

Technically, a break above 1.40 should see some new

buyers come in from the sidelines, while a breakdown

below 1.20 will probably see some panic selling, as

stop loss orders are triggered.

Hope this helps you some .....

happy days

yogi