someone call up your money your call and get them to cover it on tv

Some of them blokes know less about stocks then my 6 month old pup. Others are great, you got to be careful who you listen too on that show.

someone call up your money your call and get them to cover it on tv

Some of them blokes know less about stocks then my 6 month old pup. Others are great, you got to be careful who you listen too on that show.

From Wall Street Journal

http://online.wsj.com/community/groups/world-forum-748/topics/economic-growth-china-india-help

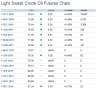

OIL FUTURES: Crude Falls Below $72 As Oversupply Concerns Grow

Light, sweet crude oil for October delivery settled $2.78, or 3.7%, lower, at $71.92 a barrel on the New York Mercantile Exchange. Brent crude on the ICE futures exchange traded down $1.99, or 2.6%, at $74.61 a barrel

Economic growth in China and India will help U.S economy

Tropoje, Albania: Albanian Minerals President & CEO Mr Mujaj said that "Economic growth in China and India will help U.S economy

Global economy is set to recover and the global consumption of gold, oil, natural gas, food and metals will increase. With 2.5 billion people China and India will be a huge market for US companies".

"Demand and prices will grow for wheat, oil, natural gas, steel, cooper, aluminum, gold, silver, iron ore, uranium, chrome ore, row materials and other metals".

The U.S. consumer confidence rose in August. The U.S. homes prices gained more than expected in June .Standard & Poor's said the prices of single-family homes in 20 major cities rose a seasonally unadjusted 1.0% in June. Another report released on Tuesday showed the pace of growth in business activity in the U.S. Indian Government report Tuesday that GDP grew at 8.8% year-over-year pace in the second quarter India's strong growth and elevated inflation keeps the door open to additional monetary tightening. The country's central bank has already increased rates four times this year.

Indian exports accounting for less than 20% of its GDP .Growth in India was led by services (55% of India's economy), which expanded by 9.7%, and manufacturing, which expanded by almost 12.5%. Mining expanded by almost 9%. Agriculture output, which accounts for about 20% of India's GDP, expanded by 2.8% after growing 0.7% in the first quarter.

Wages in India are reportedly growing at the fastest rate in Asia. Some economists expect wages to rise as much as 10% this year after 6.6% last year. China has economic growth in past three decades and the demand for oil, natural gas, coal, metals is growing at average 10% a year.

Secret German military study warns of dramatic oil crisis

Submitted by admin4 on 1 September 2010 - 12:17pm.

International

By IRNA,

Berlin : A confidential German army study warned of a looming oil crisis which could have dramatic political and economic consequences for the world, the Hamburg-based weekly news magazine Der Spiegel said Tuesday.

According to the report, a think-tank of the German army has for the first time ever analyzed the security policy dimensions of the peak oil problem.

I thought this was quite funny being a German military secret?

Not much of a secret anymore ,thanks to number 1 spy Condog lolz

NEW YORK (MarketWatch) -- Energy stocks kicked off the month of September with a powerful rally, unleashed by positive economic data from the U.S., China and Australia on Wednesday.

Energy stocks picked up steam after a report showed an unexpected rise in the U.S. ISM manufacturing index for August. A positive read on Chinese manufacturing activity and better-than-expected second-quarter economic growth in Australia also underpinned bullish sentiment in energy stocks.

The Dow Jones Industrial Average /quotes/comstock/10w!i:dji/delayed (DJIA 10,269, +254.75, +2.54%) jumped 255 points, or 2.5%. DJIA components Exxon Mobil /quotes/comstock/13*!xom/quotes/nls/xom (XOM 60.95, +0.04, +0.07%) and Chevron /quotes/comstock/13*!cvx/quotes/nls/cvx (CVX 76.79, +0.02, +0.03%) rose 3% and 4% respectively.

Outpacing gains in the broad equities market, the NYSE Arca Oil Index /quotes/comstock/10t!xoi.x (XOI 963.51, +37.63, +4.06%) rose 4% to 966.

The gauge of major oil producers has been down for 14 of the past 17 trading sessions on dimming investor hopes for a robust recovery from the recession.

Crude oil for October delivery gained $1.86, or 2.5%, to $73.72 a barrel.

Nokia, is this the start of the divergence ive been calling for a while?? Its gotta come soon imo.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.