- Joined

- 30 June 2008

- Posts

- 15,645

- Reactions

- 7,506

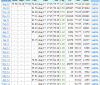

The open looks to be stacking up nicely for a new high. One tree shaker for each side but the buys look genuine to 1.12 and the sells up from 1.06

Indicative open 1.10... Coondog

You don't want to stake your life on preopening bids do you? I think we have all been burned in these markets . Amazing how quickly bids can be retracted or changed in very short time. AUT now 1.02.

__________________________________________

It does look like a great buy though ..