- Joined

- 28 May 2020

- Posts

- 6,421

- Reactions

- 12,200

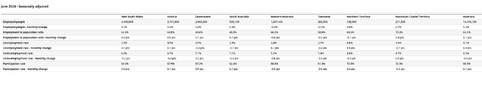

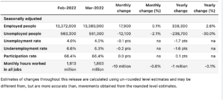

Ho hum the latest unemployment figures are out courtesy of the ABS.

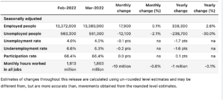

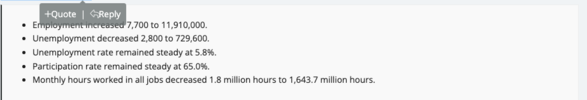

Net 18k new Jobs, unemployed people down by 12k, the - so where did these extra 6,000 employed people come from?

Underemployment went down by 0.2%. and yet the Unemployment rate stayed the same.

Must just mean more peole looking for work.

And yet there were 10 million less hours worked for the month

Were they migrants who stepped off the boat /plane and straight into a Job?

If you go back to the very first post back in 2016 made by Arty (RIP) in this thread, there are some interesting comparisons.

In six years since the above was posted, unemployment has gone down from 5.8% to 4%, the participation rate has gone up by 1.5%, the number of employed people has gone up by 1.5 million or around 12% , but the number of hours worked has only gone up by about 10%.

So the average worker is working 10% less hours than they did 6 years ago. Can we blame it all on COVID???

Mick

Net 18k new Jobs, unemployed people down by 12k, the - so where did these extra 6,000 employed people come from?

Underemployment went down by 0.2%. and yet the Unemployment rate stayed the same.

Must just mean more peole looking for work.

And yet there were 10 million less hours worked for the month

Were they migrants who stepped off the boat /plane and straight into a Job?

If you go back to the very first post back in 2016 made by Arty (RIP) in this thread, there are some interesting comparisons.

In six years since the above was posted, unemployment has gone down from 5.8% to 4%, the participation rate has gone up by 1.5%, the number of employed people has gone up by 1.5 million or around 12% , but the number of hours worked has only gone up by about 10%.

So the average worker is working 10% less hours than they did 6 years ago. Can we blame it all on COVID???

Mick