Australian employment data released today shows the economy is still creating jobs a decent rate. 14,600 jobs were added in the month of August on a seasonally adjusted basis. Remember the Australian economy needs to create approximately 15 - 20k jobs per month just to keep up with population growth and immigration. The fall in the unemployment rate reflects a drop in the particpation rate or a drop in the number of people looking for work.

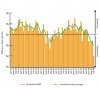

Recession has become a hot topic of debate in recent months. If you are looking for confirmation of recession in the jobs numbers, by the time you get it, the recession will likely be more than half over. As you can see from the chart below, the last two recessions started whilst the 6 month moving average change in employment was still positive. You only got real confirmation once the 6MMA fell below -15k per month. In order to get there you would need a number of consecutive month declines in employment. We are unlikely to see those kinds of numbers until the first half of 2009 at the earliest IMO.

Recession has become a hot topic of debate in recent months. If you are looking for confirmation of recession in the jobs numbers, by the time you get it, the recession will likely be more than half over. As you can see from the chart below, the last two recessions started whilst the 6 month moving average change in employment was still positive. You only got real confirmation once the 6MMA fell below -15k per month. In order to get there you would need a number of consecutive month declines in employment. We are unlikely to see those kinds of numbers until the first half of 2009 at the earliest IMO.