Knobby22

Mmmmmm 2nd breakfast

- Joined

- 13 October 2004

- Posts

- 9,760

- Reactions

- 6,692

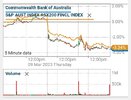

Your guess is as good as mine. I have feeling not much will happen....where will the Banks' Share Price go tomorrow, next week and next month is the question I

Maybe someone here has a deep interest in banking and can provide some insight.