>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

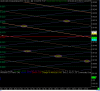

Oops, sorry about that confusion. There's the normal Bollinger Band and a couple other MA's and HMA Russian tinkered a bit for different time frames and purposes.

Some are not relevant on the weekly chart as I just converted my daily chart to a weekly to better illustrate the larger picture EW point, and haven't adjusted the 'period' in some accordingly.

Not same info duplicated, more like same info formulated a bit differently. I suppose you could say that collectively it's my attempt at a variation of a rainbow chart.

whatever helps you to see the market and profit is the right way for you Whiskers!