- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

this post is being

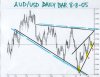

H ere we go again ...... DTM .....

WHAT A SET-UP .....

WHAT A GREAT SHORT TERM TRADE THIS COULD TURN OUT TO BE ,,,,

ALL THESE CHARTS ,,,,,,,, WHAT DOES IT ALL ADD UP TO ?

IT ADDS UP TO FIBONACCI RETRACEMENT LINES ......

Again , the reason these charts look like this is because of the study of FIBONACCI coupled with ELLIOTT WAVES ......

NOTHING ELSE COMPARES

ALWAYS REMEMBER ….

What makes a market place is all of our diffrences of opinions .

------- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

It is far more difficult to Exit a trade than to Enter a trade .... I am sure that you have heard that said before ,,,

THIS IS WHY ,

When making trade it just as important to have an idea where you want to exit as it is to place a stop to protect yourself from a move against you .

( THIS IS A PEARL OF WISDOM )

THERE IS NO HOLY GRAIL ///// I KNOW THAT YOU KNOW THIS ...

THATS WHY I TRADE ELLIOT WAVES , becase its giving you a probaility of where to look for a turn in a given market .....

The smaller the risk in relation to the price objective , the better chance of success in long haul .... (This is called Risk to Reward )

It’s just the way that is ...

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

H ere we go again ...... DTM .....

WHAT A SET-UP .....

WHAT A GREAT SHORT TERM TRADE THIS COULD TURN OUT TO BE ,,,,

ALL THESE CHARTS ,,,,,,,, WHAT DOES IT ALL ADD UP TO ?

IT ADDS UP TO FIBONACCI RETRACEMENT LINES ......

Again , the reason these charts look like this is because of the study of FIBONACCI coupled with ELLIOTT WAVES ......

NOTHING ELSE COMPARES

ALWAYS REMEMBER ….

What makes a market place is all of our diffrences of opinions .

------- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

It is far more difficult to Exit a trade than to Enter a trade .... I am sure that you have heard that said before ,,,

THIS IS WHY ,

When making trade it just as important to have an idea where you want to exit as it is to place a stop to protect yourself from a move against you .

( THIS IS A PEARL OF WISDOM )

THERE IS NO HOLY GRAIL ///// I KNOW THAT YOU KNOW THIS ...

THATS WHY I TRADE ELLIOT WAVES , becase its giving you a probaility of where to look for a turn in a given market .....

The smaller the risk in relation to the price objective , the better chance of success in long haul .... (This is called Risk to Reward )

It’s just the way that is ...

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …