- Joined

- 26 April 2009

- Posts

- 494

- Reactions

- 1

Traded this on the open on the first day. Managed about 5%.

See recent ALD / SBM on how long it takes the prices to converge.

Good idea...

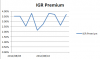

Just spent some time plotting the "premium" (implied/market price) for ALD and IGR since day 1 of the announcement.

Obviously using EOD data alone doesn't show the full dynamics, but the week 1 performance are quite different for the two, which is surprising since ALD/SBM has board and independent expert's recommendation right from the start. That would have been a much better opportunity than IGR/SLR.

I guess for IGR the premium will most likely sit in the current range until something big, e.g. independent expert's report or (ideally) a superior offer! In the meantime I should be comfortably sitting on my 4.8%...