skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

I don't know about 'true pairs trading', I would say you are referring too a long-short equity hedge fund strategy.

People take pairs trades for all kinds of reasons, many are very discretionary and rely on much more than correlation and mean reversion only. For example the 'bank stress tests' in the states, saw many going long SPI, short S&P, the assumption: good results and both banking sectors would rally, bad results would be seen as a huge negative to the US banking sector but would not indicate anything in relation to the Australian banking sector.

But I like this 'pairs scalping' style.

Yes there are many styles of pairs trading indeed. Some hold pairs intraday, some hold them for multiple years on macro trends. I actually first get exposed to this type of hedged trading from the BBC series "Million Dollar Traders" and it was a hedge strategy around news event during the GFC.

This is the area I would like to get into a bit more... just multi-leg long short strategies around equities.

My first trade was actually long RIO short BHP which was a combination of fundamentals and technicals. On hindsight obviously I didn't hold it long enough! And that's the main problem with my pairs scalping - I do leave a fair bit on the table at times... but overall I can't fault my equity curve.

Including commission x 4?

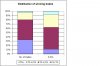

Clear 1.5-2% after commission x4 (or ~0.4%). Here's a winners distribution graph. Note 80% of trades return <3% (of leg size), and they collectively account for 62% of $$ won. It's small wins + high win rate that makes the equation profitable.