You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ASX Stock Pairs Trade Journal

- Thread starter Pairs Trader

- Start date

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Yes Ive been watching that pair over the last several sessions, was considering opening a position in it today, however I found myself pondering over it too long, and my rule is ''if in doubt, stay out'' and for several reasons im staying aside on this one, the % from the mean isn't near historical extremes, especially in the previous sessions when it first triggered, its getting closer to it today, not too far off, and I don't like the look of the ratio chart, breaking out to new highs and trending upwards, looks like blue sky ahead, the +/- is fine and spread chart is fine, however the ratio chart is what im primary concerned with and It doesn't tickle my fancy, although all that being said it may snap back to the mean tomorrow or soon enough, nothing wrong with trading it, the system is still extremely profitable without applying filters, I just try to improve on the system by filtering the signals, although plenty of guys will take all signals regardless and that's fine.

p.s. did you see my short position in MND I put on today? closed down 5.57% from my entry price! trade moved in my favor straight away, should be good to take off the table tomorrow for very nice profits.

Thanks for the comment on HVN/DJS pair. Fundamentally I don't understand why DJS and JBH both went up 5-6% on the consumer figure, while HVN only managed ~2%. Anyway, will see how this trade turn out.

Nice job on the MND. I got the signal but didn't get in. Already have 4 pairs (inlcuding the one above) so don't really feel like having more than that open. Was going to just lean on a long DOW or UGL, as the market was looking very strong, but that wouldn't have worked terribly well.

The Trigger tab in the latest version of PTF is a great improvement so well done to your team.

- Joined

- 27 November 2007

- Posts

- 56

- Reactions

- 0

Hi Pairs,

Just a couple of thoughts.

Firstly. I picked this up from another forum:

"I've noticed that whether or not you get a signal depends in part on which item is on the left and which is on the right. My sense is that the instrument with the higher price should be on the left. (It appears to me that ratios and SDs are worked out to 2 decimal places; dividing the higher number (on the left) by the lower number (on the right) gives more significant digits to work with. eg: if RDSB is at 1562 and BP is at 461, then RDSB / BP = 3.39, but BP / RDSB = 0.30; a 15p rise in BP's share price gives ratios of 3.28 vs 0.30 respectively - a significant change in one case vs no change in the other case.)"

What are your thoughts?

Secondly, I have noticed that you sometimes enter trades that have trending ratios (UGL/MND). I understand it is taboo to trade trending ratio's, however:

Assuming PTF tells me to long (or short) a ratio due it being below (or above) the rolling mean.....is it fine to long a ratio that is trending up (or short a ratio that is trending down)? From what I see you are trading a reversion to the mean, however, If that fails you are getting the added backup in that the trend of the ratio must also change.

So, for the trade to lose money (a) mean will revert at a loss (as with any normal pair trade) but also (b) the ratio trend must change. 2 things need to move against you as opposed to one.

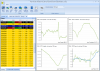

For example I went long the below ratio on this basis:

Just a couple of thoughts.

Firstly. I picked this up from another forum:

"I've noticed that whether or not you get a signal depends in part on which item is on the left and which is on the right. My sense is that the instrument with the higher price should be on the left. (It appears to me that ratios and SDs are worked out to 2 decimal places; dividing the higher number (on the left) by the lower number (on the right) gives more significant digits to work with. eg: if RDSB is at 1562 and BP is at 461, then RDSB / BP = 3.39, but BP / RDSB = 0.30; a 15p rise in BP's share price gives ratios of 3.28 vs 0.30 respectively - a significant change in one case vs no change in the other case.)"

What are your thoughts?

Secondly, I have noticed that you sometimes enter trades that have trending ratios (UGL/MND). I understand it is taboo to trade trending ratio's, however:

Assuming PTF tells me to long (or short) a ratio due it being below (or above) the rolling mean.....is it fine to long a ratio that is trending up (or short a ratio that is trending down)? From what I see you are trading a reversion to the mean, however, If that fails you are getting the added backup in that the trend of the ratio must also change.

So, for the trade to lose money (a) mean will revert at a loss (as with any normal pair trade) but also (b) the ratio trend must change. 2 things need to move against you as opposed to one.

For example I went long the below ratio on this basis:

Attachments

- Joined

- 27 October 2008

- Posts

- 291

- Reactions

- 2

Closed trade for small profits

Sold NAB @ 22.29 (0.76% profit)

Covered ANZ @ 16.68 (break-even)

Sold NAB @ 22.29 (0.76% profit)

Covered ANZ @ 16.68 (break-even)

- Joined

- 27 October 2008

- Posts

- 291

- Reactions

- 2

FRO / TNP

would you short the spread right now?

pretty strong right now

thanks pairstrader

Yes looks fine to me. Keep position size small relative to your a/c size.

- Joined

- 27 October 2008

- Posts

- 291

- Reactions

- 2

cooper, in the signal formula's we use 4 decimals to mitigate that issue you describe, plus we advise you pair trade stocks with similar prices, i.e...don't pair a $100 stock with a $1 stock. Yes normally you don't want to trade trending ratio charts, you could trade in the direction of trending ratio, not my cup of tea as trend reversals can be sharp. Your trade looks fine to me.

- Joined

- 27 November 2007

- Posts

- 56

- Reactions

- 0

we advise you pair trade stocks with similar prices, i.e...don't pair a $100 stock with a $1 stock

What is the theory behind this?

Not doubting it at all..... But if we have a stock with market cap of 5b trading at $1, another at $100, then theoretically one shouldn't outpace the other purley because of stock price?

- Joined

- 27 October 2008

- Posts

- 291

- Reactions

- 2

Well for eg.. if a $1 stock trades up 1c, that is a 1% price change, whereas a $1 movement would be required for a $100 stock to move 1%, backtesting shows similar priced stocks perform better aswell. Ideally you want the 2 stocks in the pair to be as similar as possible.

Exited trade for profits

Sold UGL @ 10.43 (2.45% profit)

Covered MND @ 11.56 (1.64% profit)

Exited trade for profits

Sold UGL @ 10.43 (2.45% profit)

Covered MND @ 11.56 (1.64% profit)

- Joined

- 27 October 2008

- Posts

- 291

- Reactions

- 2

I've got the trial version of the software. I have now got it to show the pair you have just traded but my version shows completely different entry exit points.

How do I set it up so it is the same as yours so I can try and figure out why you are entering these trades?

Note also that I don't have a trigger button.

Aurum.

How do I set it up so it is the same as yours so I can try and figure out why you are entering these trades?

Note also that I don't have a trigger button.

Aurum.

Attachments

Hey Pairs Trader,

I have been reading your thread with interest.

I just had a thought though, what if you were to compare a stock to the index?

Find a stock which correlates strongly with the index and maybe even has a beta close to 1?

I guess the index could be the ASX200, but maybe it would be better to use the industry specific index. Therefore, instead of pairing 1 stock with another, you would be pairing 1 stock against the performance of a range of stocks in a similar industry.

Obviously you would just trade the 1 stock though.

I am assuming the software would be able to do this the same way as any other pair.

This is untested and I don't have your software, just me thinking out loud.

I have been reading your thread with interest.

I just had a thought though, what if you were to compare a stock to the index?

Find a stock which correlates strongly with the index and maybe even has a beta close to 1?

I guess the index could be the ASX200, but maybe it would be better to use the industry specific index. Therefore, instead of pairing 1 stock with another, you would be pairing 1 stock against the performance of a range of stocks in a similar industry.

Obviously you would just trade the 1 stock though.

I am assuming the software would be able to do this the same way as any other pair.

This is untested and I don't have your software, just me thinking out loud.

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Obviously you would just trade the 1 stock though.

How is that pairs trading then?

- Joined

- 2 September 2008

- Posts

- 1,038

- Reactions

- 1

Um, the other pair would be the index.

If you want you can call it pairs analysis.

You could take the opposite position with the index, but I dont think it would be very successful.

OR you could Buy/Sell Futures contracts of the given index?

BUT you'd have to have alot of capital

Becuase to be dollar neutral you'd have to buy/short apporx $100,000 worth of shares for each contract.

Brad

Yeah true, but I guess a better way to pair against the ASX200 index would probably be to buy/sell the ETF: STW.

However, I've had a look around for industry specific ETF's or similar to replicate the performance of individual industries but I cant find any.

The reason I was saying it would probably be better to just trade the stock is because the stock should move with the index. But, if a stock is for some reason out of sync with the index chances are the stock will move to close its gap with the index. The index won't be moving to close the gap with an individual stock.

However, I've had a look around for industry specific ETF's or similar to replicate the performance of individual industries but I cant find any.

The reason I was saying it would probably be better to just trade the stock is because the stock should move with the index. But, if a stock is for some reason out of sync with the index chances are the stock will move to close its gap with the index. The index won't be moving to close the gap with an individual stock.

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

The reason I was saying it would probably be better to just trade the stock is because the stock should move with the index. But, if a stock is for some reason out of sync with the index chances are the stock will move to close its gap with the index. The index won't be moving to close the gap with an individual stock.

Thats what I thought you were getting at with my last comment.

And its very wrong.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Yeah true, but I guess a better way to pair against the ASX200 index would probably be to buy/sell the ETF: STW.

However, I've had a look around for industry specific ETF's or similar to replicate the performance of individual industries but I cant find any.

The reason I was saying it would probably be better to just trade the stock is because the stock should move with the index. But, if a stock is for some reason out of sync with the index chances are the stock will move to close its gap with the index. The index won't be moving to close the gap with an individual stock.

There are other ETF like SLF for REITs plus some of the friendly CFD providers off sector index products.

One thing to watch with this is because the stock is inevitably contained in the index, you will always lose a little bit on the spread for the component in the index. E.g. Pairing SLF with WDC would be somewhat pointless as Westfield makes up ~half of SLF. Same with Big 4 in the banking sector (probably ~20-22% each).

- Joined

- 27 October 2008

- Posts

- 291

- Reactions

- 2

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

New trade

Long TSE @ 2.67

Short UGL @ 10.75

I can't short UGL with my IG account. Which provider are you using for the short leg?

- Joined

- 27 October 2008

- Posts

- 291

- Reactions

- 2

Yes I noticed that aswell, had to use my CMC a/c to short it.

Similar threads

- Replies

- 22

- Views

- 2K

- Replies

- 21

- Views

- 3K

- Replies

- 3

- Views

- 367

- Replies

- 79

- Views

- 5K

- Replies

- 44

- Views

- 3K