- Joined

- 12 January 2008

- Posts

- 7,327

- Reactions

- 18,281

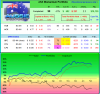

EOW 47 update: ASX Momentum portfolio +23.4% ( 70% invested in 5 trades ) XAO -15.8% (past 47wk)

End of another volatile week and the ASX looks like pausing at this level. Both the index and our portfolio ended higher this week. We've started two new trades this week as their prices made new highs. This could be the calm before another storm. I don't know.

This weeks sells: nil

This weeks buys: DTL, LPE

Outlook: remains ugly, although I'm relieved by the pause in the relentless selling. We will stick to our strategy of buying break outs and ignore the temptation of buying bargains.

End of another volatile week and the ASX looks like pausing at this level. Both the index and our portfolio ended higher this week. We've started two new trades this week as their prices made new highs. This could be the calm before another storm. I don't know.

This weeks sells: nil

This weeks buys: DTL, LPE

Outlook: remains ugly, although I'm relieved by the pause in the relentless selling. We will stick to our strategy of buying break outs and ignore the temptation of buying bargains.