- Joined

- 12 January 2008

- Posts

- 7,407

- Reactions

- 18,523

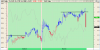

EOW 35 update: ASX Momentum Portfolio +22.5% ( 96% invested in 8 stocks ) XAO -10.3% (past 35wk)

Our portfolio (+2.3%) bucked the market drift downward (-1.8%) thanks to our position in APO which gapped higher on good news. We've taken this serendipitous profit and sold at 4.80 this afternoon. Yes, another discretionary exit, but the result is well above average. It also realises a major portion of our open profits and can now be used to increase our initial trade risk (compounding).

This weeks sells: MND-cfd (small loss), APO (huge profit)

This weeks buys: EGH, SIP, TPM-cfd

We have 13.5K cash and can use it to start further trades next week. Come'on the break outs!

Outlook: I remain moderately bullish and this little dip mollifies any media bullishness.

Our portfolio (+2.3%) bucked the market drift downward (-1.8%) thanks to our position in APO which gapped higher on good news. We've taken this serendipitous profit and sold at 4.80 this afternoon. Yes, another discretionary exit, but the result is well above average. It also realises a major portion of our open profits and can now be used to increase our initial trade risk (compounding).

This weeks sells: MND-cfd (small loss), APO (huge profit)

This weeks buys: EGH, SIP, TPM-cfd

We have 13.5K cash and can use it to start further trades next week. Come'on the break outs!

Outlook: I remain moderately bullish and this little dip mollifies any media bullishness.

And neither will these,

And neither will these,