- Joined

- 12 January 2008

- Posts

- 7,334

- Reactions

- 18,305

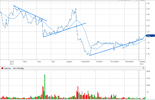

In response to a suggestion to look at ASB for a break-out entry.

ASB: Thanks. I looked at this at the 1.90 and 2.10 (BO levels), but declined to buy. I've traded this successfully in the past (huge trend up), but it's prone to large spikes down. Not suitable (imo) for a tight exit stop, but trending up solidly. Great weekly chart since the BO back at 1.00.