You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Are you doing better than Marcus Padley over the last 6 months?

- Thread starter Onan

- Start date

-

- Tags

- marcus padley

I've been following Padley since his original newsletter. Not always as a subscriber, but sometimes. I enjoyed hearing his frank views on the status of the Australian market.

Unfortunately, he has moved far away from his original newsletters.

Padley (or more correctly, his newsletter business) lost me when, in the newsletter, he started making portfolio decisions as a fund manager, instead of as a stock market newsletter writer. Sad days.

KH

Unfortunately, he has moved far away from his original newsletters.

Padley (or more correctly, his newsletter business) lost me when, in the newsletter, he started making portfolio decisions as a fund manager, instead of as a stock market newsletter writer. Sad days.

KH

- Joined

- 20 July 2021

- Posts

- 10,973

- Reactions

- 15,238

better than Marcus this year ??

probably

better than the XJO

just maybe , take-overs and exits have made the calculations blurry ( i am holding more cash than January 1st , and have bought extra stuff with savings from elsewhere , so it isn't oranges v. oranges

- Joined

- 20 July 2021

- Posts

- 10,973

- Reactions

- 15,238

Thats right Padley has lost money in a crazy bull market. That makes this video kinda funny

well September 2019 ( Repo Madness ) was a big signal for me , and started sensibly taking cash off the table ready for what came in March 2020 , but taking a punt on KGN in January 2020 ( @ $5.64 ) in case we followed the Chinese lockdown strategy

sure i didn't pick the month or amount of fall , but spotting something was seriously wrong with the money market ( and bulking up cash )

well that isn't rocket science

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Again we are talking apples and oranges here when we make pure comparisons.

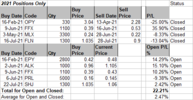

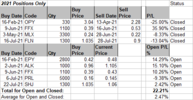

But if we take a majority small cap portfolio such as Speculative Stock Portfolio on this Stock Forum, we are outperforming with stock picks for 2021 timeframe only, taking into account all closed and current open positions:

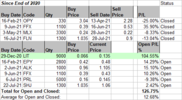

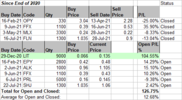

Results improve drastically if we go a few days back to end of December last year to include a current open portfolio position in Lithium Australia NL (LIT) that is doing really well:

Haven't included dividends here as this was done as a quick performance calculation table. If we did, that would add a small % to the above results.

But if we take a majority small cap portfolio such as Speculative Stock Portfolio on this Stock Forum, we are outperforming with stock picks for 2021 timeframe only, taking into account all closed and current open positions:

Results improve drastically if we go a few days back to end of December last year to include a current open portfolio position in Lithium Australia NL (LIT) that is doing really well:

Haven't included dividends here as this was done as a quick performance calculation table. If we did, that would add a small % to the above results.

- Joined

- 20 July 2021

- Posts

- 10,973

- Reactions

- 15,238

the only share on your list i look at from time to time is SHJ ( but then i remember the scorching i got in SGH , sigh , and move on )

good work and good luck

( i guess we aren't going to compete over the same parcel of shares very often )

good work and good luck

( i guess we aren't going to compete over the same parcel of shares very often )

- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Good on you @divs4ever I expect Shine Justice Ltd (SHJ) to be doing well over the medium to long term and continue to reward shareholders with dividends. SHJ offers a good yield in the current interest rate environment and as we discussed in the spec portfolio, they are doing it in a sustainable way from current profits and not from borrowings. Also great to see they've been increasing dividends of late:the only share on your list i look at from time to time is SHJ ( but then i remember the scorching i got in SGH , sigh , and move on )

good work and good luck

( i guess we aren't going to compete over the same parcel of shares very often )

Slow and steady, almost a boring business. Just the way we like them.

If we see this law firm doing exciting things like becoming greedy and take on a huge pile of debt to take over a massive UK law firm as Slater & Gordon Limited (SGH) did, that'll be our signal to get out.

- Joined

- 20 July 2021

- Posts

- 10,973

- Reactions

- 15,238

boring i can live with ( especially if they can spit out a regular div. )

but was much too slow to react with SGH

i should have known better than to buy in , in the first place ( opportunists like that are always liable to be hooked by the gills )

oh well a strong reminder to be cautious

i did a quick U-turn with ART and their new acquisition , a better and profitable result that time

but was much too slow to react with SGH

i should have known better than to buy in , in the first place ( opportunists like that are always liable to be hooked by the gills )

oh well a strong reminder to be cautious

i did a quick U-turn with ART and their new acquisition , a better and profitable result that time

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

Yup...I'm doing better than Padley--although not sure beating Padley is that tough is it? Overall I'm up 11.76% since the start of the year (excluding divs).

Dona Ferentes

A little bit OC⚡DC

- Joined

- 11 January 2016

- Posts

- 15,080

- Reactions

- 20,447

12.71% incl. dividends (from 01 Jan)

32.92% for 12 mths

32.92% for 12 mths

- Joined

- 24 May 2013

- Posts

- 562

- Reactions

- 713

i run 4 separate portfolios - since Jan 1 including divs:

ASX buy & hold: 6.4% (dragged down by CSL which is my largest individual holding, but it's done so much heavy lifting over the last few years, so if it wants to take a bit of a breather this year i'm cool with that)

ASX options/short term trading: 17.8% (biggest contributor was a CBA position resulting from a Jan short put assignment to strip the Feb div, ended up holding onto it as i couldn't find anything better to do with the collateral once the 45 days were up, got lucky when it duly rallied and rode it up to $100 before it got called away a few weeks ago)

International ETFs: 19.6% (no currency hedging, so helped out a bit by AUD/USD depreciating this year)

SGX: 10.9% constant currency, 13.2% in AUD terms as AUD/SGD has also depreciated this year (though on a like for like basis it would be somewhat higher than that, since as a Singapore tax resident i don't pay tax on SGX capital gains or divs)

ASX buy & hold: 6.4% (dragged down by CSL which is my largest individual holding, but it's done so much heavy lifting over the last few years, so if it wants to take a bit of a breather this year i'm cool with that)

ASX options/short term trading: 17.8% (biggest contributor was a CBA position resulting from a Jan short put assignment to strip the Feb div, ended up holding onto it as i couldn't find anything better to do with the collateral once the 45 days were up, got lucky when it duly rallied and rode it up to $100 before it got called away a few weeks ago)

International ETFs: 19.6% (no currency hedging, so helped out a bit by AUD/USD depreciating this year)

SGX: 10.9% constant currency, 13.2% in AUD terms as AUD/SGD has also depreciated this year (though on a like for like basis it would be somewhat higher than that, since as a Singapore tax resident i don't pay tax on SGX capital gains or divs)

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,464

- Reactions

- 1,463

i remember the scorching i got in SGH , sigh , and move on )

Me too, will never touch a legal stock again...was criminal what those clowns did.

As for Marcus - i like him and his commentary, sad he's not doing better with the fund.

- Joined

- 8 June 2008

- Posts

- 12,413

- Reactions

- 18,064

Last 6 months was a blood bath with my systems.helped a little bit by usd exposure and some investments portfolio resilts but overall negative. I do not do calendar year checks but went from healthy returns in January to 0 in july

so probably -10% or so of total funds..not all invested..for the first half

so probably -10% or so of total funds..not all invested..for the first half

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

All those legal stocks are complete dogs—IPH, QIP and several others. All IPO to great fanfare only to sink south pretty quickly and fail to deliver on expectations. Often think law firms should stay away from listing and simply stay as private partnershipsMe too, will never touch a legal stock again...was criminal what those clowns did.

- Joined

- 24 May 2013

- Posts

- 562

- Reactions

- 713

As for Marcus - i like him and his commentary, sad he's not doing better with the fund.

yeah i used to enjoy reading his articles on the smh as well. haven't seen them for a while now. did his contract with Fairfax end or something?

Dona Ferentes

A little bit OC⚡DC

- Joined

- 11 January 2016

- Posts

- 15,080

- Reactions

- 20,447

Those numbers are from my SMSF. A Barbell - local 65% and International 18%, of LICs plus speccies. 12% in ILBs, 4% Private equity12.71% incl. dividends (from 01 Jan)

32.92% for 12 mths

And in my own name, ASX Bought and Held. since 01 Jan; 15.1%, full 12 mths ; 28.8%. (ditto on CSL)i run 4 separate portfolios - since Jan 1 including divs:

ASX buy & hold: 6.4% (dragged down by CSL which is my largest individual holding, but it's done so much heavy lifting over the last few years, so if it wants to take a bit of a breather this year i'm cool with that)

- contains 8 stocks though has had others now sold; probably paid $100K, market value now well into 7 figures, dividends of $35K + franking. - Mainly bought decades ago; BHP '85, CBA both tranches of float '91 & '93, ANZ '92, WES '93, AFI '92, MND 2003 , CSL 2005 + COL spun out. Am free carried on most as I have been in and out , mainly on rights issues/SPPs. And most are multiple baggers - it is nice to receive dividends pushing 25-50% of invested capital each year.

- Joined

- 24 May 2013

- Posts

- 562

- Reactions

- 713

I do not do calendar year checks but went from healthy returns in January to 0 in july

i don't keep my YTD etc. figures handy either, i just update the raw $ figures in my spreadsheet after the last trading day of the month (except the options/short term portfolio, which i update every day due to its nature) and backup/archive my financial spreadsheet to serve as a "restore point" (disk space is cheap these days after all) in case i go and rejig some worksheets/formulas later and mess it up.

but on seeing this thread, thought it would be an interesting exercise to dig out the archive from dec 2020, do the necessary calcs and see how the different portfolios were doing. i knew my ASX buy & hold section would underperform this year because of the heavy CSL weighting, but didn't realise just how far below the index it was until actually doing the calcs.

- Joined

- 20 July 2021

- Posts

- 10,973

- Reactions

- 15,238

i am WATCHING ( not buying ) QIP currently the share price is above my target ( ditto for SHJ )All those legal stocks are complete dogs—IPH, QIP and several others. All IPO to great fanfare only to sink south pretty quickly and fail to deliver on expectations. Often think law firms should stay away from listing and simply stay as private partnerships

previously i held XIP ( taken over by IPH ) and yes i made a profit on that in the past i held IMG ( and their hybrid note ) ( IMF has since 'rebranded ' ) and left with modest profits there

i also held SGH where the outcome was nothing close to break-even ( in a bad way )

these companies involve themselves in legal cases , and sometimes these cases go for years ( decades ) so you must take forecasts with a bag of salt .

now sure the IP looks like a commercial tax ( or insurance policy ) ,regular yearly income from the client but it is those few litigations that can be a gorilla with a wrench ( tying up time and resources )

DYOR ( very carefully in this area )

now if we are talking about fund managers/analysts and their support for different investment areas , maybe a deep dive into the research is still necessary , before you part with your cash

i would suggest IF you buy into this sector you watch it closely AND be ready to jump if necessary ( SGH for one proved they had no ability to do due diligence , nor auditing capability )

- Joined

- 20 July 2021

- Posts

- 10,973

- Reactions

- 15,238

div. returns this year could easily be as stressed as they were last year

now a question must be asked , given the current lock-down addiction , will some companies withhold ( or trim ) divs ( like they did in 2020 ) to boost emergency reserves ( or bulk up for opportunistic acquisitions )

if one of those relying on div. income that is a very important consideration

take care ( when chasing div. returns )

now a question must be asked , given the current lock-down addiction , will some companies withhold ( or trim ) divs ( like they did in 2020 ) to boost emergency reserves ( or bulk up for opportunistic acquisitions )

if one of those relying on div. income that is a very important consideration

take care ( when chasing div. returns )

Similar threads

- Replies

- 8

- Views

- 444

- Replies

- 15

- Views

- 2K

- Replies

- 21

- Views

- 2K