- Joined

- 30 September 2012

- Posts

- 741

- Reactions

- 373

I haven't actually ever gotten into Ben Graham's works much - I've mainly learned from others who have no doubt also stood upon his shoulders. I must change that, as he was more quant than I realised.

Anyway, after looking at the "Top Stocks" recently, which have a couple criteria in line with Graham's, I decided to look at Gaham's criteria in more depth, and there's a bit to it.

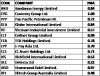

The below are those that meet the Graham criteria (to the best of my ability)...with a couple points first:

- I have not used 10 and 20 years for things like earnings and dividends. I've used 5 years (which is co-incidental to Top Stocks). Otherwise we might not get any stocks at all! 5 years will have to do.

- I've sorted the table via Revenues, because I have not applied that critieria. As in, the blue chips, or highest revenues are the true Graham selections here, but some individual investors might not have any problems with the smaller companies.

- I've looked at liquidity but decided to leave them all intact. So, as you would anyway - apply your own liquidity rules.

- "PGP" is what I call "Price to Graham Price". Smaller is better. Less than "1.00" means the current price is 'value' (less than) the current "Graham Price".

19 stocks have made it. Many are a decent size and liquidity.

If you were to stick to the higher revenue companies (as per Graham), with decent liquidity you might go down to around "IRE".

Of course, for current purchases you'd want a PGP less than 1.00, which gives 2 current stocks for the ASX:

FWD & SGH.

7 other's have a value PGP but you'd want to check out size/liquidity for yourself etc. And certainly, from what (little) I've read, there's no reason not to do that - except perhaps as you get smaller you might want to slightly increase your demand for value (a smaller PGP). For example, LCM looks good on this basis, with good liquidity still.

Thanks to this thread for inspiring me to take a look.

Anyway, after looking at the "Top Stocks" recently, which have a couple criteria in line with Graham's, I decided to look at Gaham's criteria in more depth, and there's a bit to it.

The below are those that meet the Graham criteria (to the best of my ability)...with a couple points first:

- I have not used 10 and 20 years for things like earnings and dividends. I've used 5 years (which is co-incidental to Top Stocks). Otherwise we might not get any stocks at all! 5 years will have to do.

- I've sorted the table via Revenues, because I have not applied that critieria. As in, the blue chips, or highest revenues are the true Graham selections here, but some individual investors might not have any problems with the smaller companies.

- I've looked at liquidity but decided to leave them all intact. So, as you would anyway - apply your own liquidity rules.

- "PGP" is what I call "Price to Graham Price". Smaller is better. Less than "1.00" means the current price is 'value' (less than) the current "Graham Price".

19 stocks have made it. Many are a decent size and liquidity.

If you were to stick to the higher revenue companies (as per Graham), with decent liquidity you might go down to around "IRE".

Of course, for current purchases you'd want a PGP less than 1.00, which gives 2 current stocks for the ASX:

FWD & SGH.

7 other's have a value PGP but you'd want to check out size/liquidity for yourself etc. And certainly, from what (little) I've read, there's no reason not to do that - except perhaps as you get smaller you might want to slightly increase your demand for value (a smaller PGP). For example, LCM looks good on this basis, with good liquidity still.

Thanks to this thread for inspiring me to take a look.