The thing that bothers me most about the discussion above is that I have a completely different understanding of what Buffett is doing with Burlington North Santa Fe (BNSF).

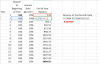

Checking the cash flow statements and balance sheets on the BNSF website (as they are still filed separately from Berkshire as a consolidated entity) it seems to me that Berkshire is sucking cash out of BNSF and replacing / funding the difference with debt and also using additional debt to Fund expansionary capex.

He is effectively increasing the leverage of the asset, like he has done with other utilities, by using Berkshire's immense financial pedigree to extract cheap capital out of the debt markets.

In fact, he is doing exactly what APA is doing, with his approach to his monopolized utility based assets. the big difference is that Berkshire can get cheaper rates from the debt market than APA (currently the difference is about 1.5%).

It's not unusual for Buffett, leveraging low-beta with cheap capital.

Checking the cash flow statements and balance sheets on the BNSF website (as they are still filed separately from Berkshire as a consolidated entity) it seems to me that Berkshire is sucking cash out of BNSF and replacing / funding the difference with debt and also using additional debt to Fund expansionary capex.

He is effectively increasing the leverage of the asset, like he has done with other utilities, by using Berkshire's immense financial pedigree to extract cheap capital out of the debt markets.

In fact, he is doing exactly what APA is doing, with his approach to his monopolized utility based assets. the big difference is that Berkshire can get cheaper rates from the debt market than APA (currently the difference is about 1.5%).

It's not unusual for Buffett, leveraging low-beta with cheap capital.