Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,134

- Reactions

- 11,246

Still bullish while $1.70 ish holds. Yes, relies on POG strength and the overall market. Once people start selling just about everything is effected.After a strong run on high volume during mid-late May, Andean tapered off in June. I think the chart looks like a flag pattern which should be bullish, assuming gold holds up. Thoughts?

The resource upgrade expected in May didn't make it out till 9 June, but was along expected lines. More ounces to be added due to recent new discoveries. Amazing overall grades.

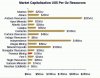

They're also doing some sort of capital raising for CAD90m which will look handy in the bank, but dilutes them quite a bit too. Not sure how 'cheap' they are looking with mc to oz au now, even with those grades..

ANDEAN RESOURCES REPORTS AN UPDATED RESOURCE AT THE EUREKA VEINS

Highlights

• Updated independent Resource Estimate for Eureka Veins delivers:

a 38% increase in the Indicated gold Resource to 1.4M oz Au; and

a 20% increase in the global gold Resource at Eureka

• The increase in gold and silver resource will significantly improve the already robust project economics at Cerro Negro, which are currently the subject of a Bankable Feasibility Study (“BFS”).

• Eureka West indicated resource zone diluted grade of 12.5 g/t Au and 184 g/t Ag gives a combined grade of 15.6 g/t AuEq (gold equivalent), making Eureka one of the highest-grade undeveloped gold projects in the world

• A very high-grade core to the mineralization exists with approximately 2.5 million tonnes at 17.2 g/t Au and 223 g/t Ag of indicated material identified to date

• The Eureka vein system remains open at depth and along strike, with only 25% of the known strike length of the outcropping Eureka vein system included in this resource estimate.

• Further upside potential remains at Cerro Negro, following the recent highgrade Bajo Negro vein discovery (not included in this estimate)

June 25, 2009, Perth Australia -- Andean Resources (AND:ASX; AND:TSX) is pleased to announce that it has entered into an agreement with a syndicate of underwriters led by BMO Capital Markets, including CIBC World Markets, Paradigm Capital, RBC Capital Markets, Thomas Weisel Partners, UBS Securities, Haywood Securities, and Dundee Capital Markets, under which the underwriters have agreed to buy on a “bought deal” basis by way of a short

form prospectus, a total of 56,250,000 Common Shares (the “Common Shares”), at a price of C$1.60 per Common Share for gross proceeds of C$90,000,000.