- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,225

No, but i'll check it out thanks GB.

Geez GB, how do i get rid of the VWAP now that is on the chart?

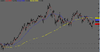

You can just //comment// these lines out so they don't plot. I quite like them, but not sure if they have a use yet.

//Prior period VWAP centerline

//PPC = ValueWhen( newPeriod == True, Ref(VWAP, -1), 1);

//Plot ( PPC, "PPC", colorBlue, styleDots|styleNoLine|styleNoRescale );

//Plot ( VWAP, "VWAP", colorBlue, styleLine );

//Plot ( stddev_1_pos, "VWAP_std+1", ColorRGB( 128, 0, 0 ), styleDashed );

//Plot ( stddev_1_neg, "VWAP_std-1", ColorRGB( 0, 128, 0 ), styleDashed );

//Plot ( stddev_2_pos, "VWAP_std+2", colorRed, styleDashed | styleThick );

//Plot ( stddev_2_neg, "VWAP_std-2", colorGreen, styleDashed | styleThick );

//Plot ( stddev_3_pos, "VWAP_std+3", colorDarkRed, styleDots | styleThick );

//Plot ( stddev_3_neg, "VWAP_std-3", colorDarkGreen, styleDots | styleThick );

I think you might prefer Anderson's code, since it includes buy and sell volume color-coded, but you will need the latest version of AB to test it.