CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

I thought i might start this thread to place some interesting code that i come across in other forums etc. Makes it a little easier to find and we can share interesting things as well.

This code looks for line that you've drawn as support or reistance. I have not tried this yet, but just thought some might find it interesting....

Cheers,

CanOz

This code looks for line that you've drawn as support or reistance. I have not tried this yet, but just thought some might find it interesting....

Cheers,

CanOz

Code:

//------------------------------------------------------------------------------

//

// Formula Name: half-automated Trading System

// Author/Uploader: Thomas Zmuck

// E-mail: thomas.zm@aon.at

// Date/Time Added: 2001-12-21 16:45:47

// Origin:

// Keywords: half-automated Trading System

// Level: basic

// Flags: system,exploration

// Formula URL: http://www.amibroker.com/library/formula.php?id=142

// Details URL: http://www.amibroker.com/library/detail.php?id=142

//

//------------------------------------------------------------------------------

//

// This System finds stocks, where the price reached a support or resistance

// line, that you have manually drawn.

//

// You must give every line any of these 6 predifined StudyID's

//

// (RE,SU,UP,DN,RI,ST). The system automaticaly detects, if the line is

// currently a support or resistance line.

//

// There are two modes: Modus == 0; I called it "after touching" , because you

// become the signal after the stock has touched any support or resistance

// line.Adjustment for touching is "ALvalue and AHvalue" With ALvalue you can

// define, how near the Low must go to any support line, equivalent AHvalue to

// resistance line, before a signal is given.

//

// With Modus == 1 "bLvalue and bHvalue" you can detect stocks, where the

// price is before touching any line, so you mostly can find signals for the

// next trading day and so you have enough time to check other arguments and

// then you can buy at the exact support Level or sell at the exact resistance

// level.

//

// Cross_buy_value = 1.03; Cross_sell_value = 0.97;

//

// Here you can define the value, where the price must reached, before a

// signal would be generated. For example: 1.03 means that a buy signal is

// given, when the price is 3% above the last resistance. equivalent the

// cross_sell_value.

//

// With the Explore Function you can see the distance from the current close

// to all support and resistance lines in percent.

//

// Re = Resistance Su = Support

//

// In the indicator window you can see the close and all your study's

// (currently 6 study's possible).

//

// So you can quickly see, if you've forgotten to give a study ID to any line.

//

// Attention: Dont forget, that the back-test brings unrealistic results,

// because the signals only real at the time that you've drawn the study.

//

// Also dont forget in the explore window, that only the resistance and

// support distances are shown, that you have drawn and defined with a study

// ID.

//

// So enjoy it!

//

// Every comments are welcome

//

//------------------------------------------------------------------------------

Modus = 0;

/*Modus 0 = after touching (bLvalue and bHvalue)*/

/*Modus 1 = before touching* (ALvalue and AHvalue)*/

bLvalue = 1.06; ALvalue = 1.02;

bHvalue = 0.93; AHvalue = 0.99;

Cross_buy_value = 1.03;

Cross_sell_value = 0.97;

/*this is the value, where a line cross is defined as true, it's a way to ignore false breakout's default = 3 % */

MLV = IIf (Modus ==0, ALvalue,

bLvalue);/*Modus_Low_value */

MHV = IIf (Modus ==0, AHvalue, bHvalue);/*Modus_High_value */

/*Study - Definition - give your name's */

L1 = Study ("SU"); L2 = Study ("RE"); L3 = Study ("DN");

L4 = Study ("UP"); L5 = Study ("RI"); L6 = Study ("ST");

/*Buy Conditions*/

N1 = L <= MLV * L1 AND IIf(Modus == 1,L >= Alvalue * L1,C>0) AND C > L1 AND Ref (L,-1)>L1;

N2 = L <= MLV * L2 AND IIf(Modus == 1,L >= Alvalue * L2,C>0) AND C > L2 AND Ref (L,-1)>L2;

N3 = L <= MLV * L3 AND IIf(Modus == 1,L >= Alvalue * L3,C>0) AND C > L3 AND Ref (L,-1)>L3;

N4 = L <= MLV * L4 AND IIf(Modus == 1,L >= Alvalue * L4,C>0) AND C > L4 AND Ref (L,-1)>L4;

N5 = L <= MLV * L5 AND IIf(Modus == 1,L >= Alvalue * L5,C>0) AND C > L5 AND Ref (L,-1)>L5;

N6 = L <= MLV * L6 AND IIf(Modus == 1,L >= Alvalue * L6,C>0) AND C > L6 AND Ref (L,-1)>L6;

P1 = C > L1*Cross_buy_value AND (Ref (C,-1)<L1 OR Ref (C,-2)<L1);

P2 = C > L2*Cross_buy_value AND (Ref (C,-1)<L2 OR Ref (C,-2)<L2);

P3 = C > L3*Cross_buy_value AND (Ref (C,-1)<L3 OR Ref (C,-2)<L3);

P4 = C > L4*Cross_buy_value AND (Ref (C,-1)<L4 OR Ref (C,-2)<L4);

P5 = C > L5*Cross_buy_value AND (Ref (C,-1)<L5 OR Ref (C,-2)<L5);

P6 = C > L6*Cross_buy_value AND (Ref (C,-1)<L6 OR Ref (C,-2)<L6);

/*Sell Conditions*/

Q1 = H >= MHV * L1 AND IIf(Modus == 1,H <= AHvalue * L1,C>0) AND C < L1 AND Ref (H,-1)<L1;

Q2 = H >= MHV * L2 AND IIf(Modus == 1,H <= AHvalue * L2,C>0) AND C < L2 AND Ref (H,-1)<L2;

Q3 = H >= MHV * L3 AND IIf(Modus == 1,H <= AHvalue * L3,C>0) AND C < L3 AND Ref (H,-1)<L3;

Q4 = H >= MHV * L4 AND IIf(Modus == 1,H <= AHvalue * L4,C>0) AND C < L4 AND Ref (H,-1)<L4;

Q5 = H >= MHV * L5 AND IIf(Modus == 1,H <= AHvalue * L5,C>0) AND C < L5 AND Ref (H,-1)<L5;

Q6 = H >= MHV * L6 AND IIf(Modus == 1,H <= AHvalue * L6,C>0) AND C < L6 AND Ref (H,-1)<L6;

R1 = C < L1*Cross_sell_value AND (Ref (C,-1)>L1 OR Ref (C,-2)>L1);

R2 = C < L2*Cross_sell_value AND (Ref (C,-1)>L2 OR Ref (C,-2)>L2);

R3 = C < L3*Cross_sell_value AND (Ref (C,-1)>L3 OR Ref (C,-2)>L3);

R4 = C < L4*Cross_sell_value AND (Ref (C,-1)>L4 OR Ref (C,-2)>L4);

R5 = C < L5*Cross_sell_value AND (Ref (C,-1)>L5 OR Ref (C,-2)>L5);

R6 = C < L6*Cross_sell_value AND (Ref (C,-1)>L6 OR Ref (C,-2)>L6);

/*Buy & Sell PART*/

Buy = N1 OR N2 OR N3 OR N4 OR N5 OR N6 OR

P1 OR P2 OR P3 OR P4 OR P5 OR P6;

Sell = Q1 OR Q2 OR Q3 OR Q4 OR Q5 OR Q6 OR

R1 OR R2 OR R3 OR R4 OR R5 OR R6;

/*Explore-Part*/

L1_diff = (L1/ C -1)*100;

L2_diff = (L2/ C -1)*100;

L3_diff = (L3/ C -1)*100;

L4_diff = (L4/ C -1)*100;

L5_diff = (L5/ C -1)*100;

L6_diff = (L6/ C -1)*100;

Filter = Buy OR Sell;

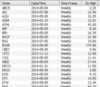

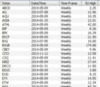

AddColumn( L1_diff, WriteIf (C > L1 ,"Su1_%", "Re1_%"),1.1 );

AddColumn( L2_diff, WriteIf (C > L2 ,"Su2_%", "Re2_%"),1.1 );

AddColumn( L3_diff, WriteIf (C > L3 ,"Su3_%", "Re3_%"),1.1 );

AddColumn( L4_diff, WriteIf (C > L4 ,"Su4_%", "Re4_%"),1.1 );

AddColumn( L5_diff, WriteIf (C > L5 ,"Su5_%", "Re5_%"),1.1 );

AddColumn( L6_diff, WriteIf (C > L6 ,"Su6_%", "Re6_%"),1.1 );

/*Graph-Part*/

Plot (C,"close",1,64);

Plot (L1,"L1",2,1);/*white*/

Plot (L2,"L2",5,1);/*green*/

Plot (L3,"L3",7,1);/*yellow*/

Plot (L4,"L4",4,1);/*red*/

Plot (L5,"L5",6,1);/*blue*/

Plot (L6,"L6",9,1);/*orange*/