- Joined

- 18 June 2010

- Posts

- 277

- Reactions

- 0

ok amibroker gurus, i would like some help please.

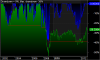

in the following equity line chart in a report in amibroker;

1. how can i get it to plot the y axis on a log scale like the ones in unholy grails?

2. for some reason the x axis scale is not evenly spaced - in whatever afl i use the 2010 / 2011 period always is condsierably wider than other years. could it be that there are just many more trades in that period and each 'tick' is a trade rather than unit of time? in UG they all appar to be evenly spaced.

thanks

in the following equity line chart in a report in amibroker;

1. how can i get it to plot the y axis on a log scale like the ones in unholy grails?

2. for some reason the x axis scale is not evenly spaced - in whatever afl i use the 2010 / 2011 period always is condsierably wider than other years. could it be that there are just many more trades in that period and each 'tick' is a trade rather than unit of time? in UG they all appar to be evenly spaced.

thanks