"Rann said that subject to Alliance and Quasar board approvals the Four Mile joint venture is planning to submit a mining lease application for development by the end of this year for development of "a major mine.""

Australian uranium again impacted by political swings and roundabouts

Conflicting policies have been announced by the State Premiers of Queensland and South Australia on uranium mining in their jurisdictions.

Author: Ross Louthean

Posted: Monday , 02 Apr 2007

PERTH -

The Australian share market's view of political certainty for sweeping change by the Australian Labor Party (ALP) to its restrictive policy on uranium mining and exports took one step backwards and another forward today with comments by Labor Premiers in the key states of Queensland and South Australia.

This comes within less than four weeks before the national conference of the ALP meets to discuss major policy issues including whether the No New Mines policy would be changed to a more open policy on allowing new mines. Labor controls all state governments and has its Federal Leader Kevin Rudd leading Prime Minister John Howard in opinion polls, and Rudd will be leading the push for change.

Political observers had been seeing the party rump falling in line with Rudd's wish and that included Queensland Premier Peter Beattie. However, today Beattie told an ABC News programme that if conference gave the states discretion on this issue, then he would not allow uranium mining.

Clearly, the anti uranium hardliners in the party will be pushing for discretionary powers as a second fall back line and, if so, then Queensland with some of Australia's huge undeveloped deposits would close its doors, along with Western Australia where Premier Alan Carpenter has been saying for some time there would be no uranium mines under his reign.

The Northern Territory, where Chief Minister Clare Martin made it clear at her re-election last year that she would ban new uranium mines, is in a political conundrum for the Federal Liberal government made it clear that it was a dependency of Canberra which wants new mines, and that would happen.

A pro development policy may be invoked for the NT even if Rudd beats Howard at the next Federal election, however, one day in the life of Australian uranium politics is proving right now to be a variation on the next.

Beattie's comments will spook many investors in Queensland uranium stocks, including Summit Resources which owns 100% of several deposits near Mount Isa and owns other key deposits 50/50 with Paladin Resources which has mounted a hostile takeover.

However, the immediate response on he tAustralian Stock Exchange trading today was a minor slip in Summit's price by $A0.13 to the $A4.80 range.

In contrast to Queensland, the pro mining state of South Australia which hosts two of the country's uranium mines - BHP Billiton's Olympic Dam and Heathgate Resources' Beverley - made it clear it would be supporting an end to the ALP's current policy and development of one of the country's exciting new discoveries. This is Four Mile, near Beverley, where Heathgate's search arm Quasar Resources is earning 70% from junior Alliance Resources.

SA Premier Mike Rann, speaking from Chile, released today a statement to coincide with Alliance-Quasar's announcement of more drilling leading to a scoping and pre-feasibility study.

Last year SA's Mines Minister Paul Holloway told this writer that it had already granted SXR Uranium One a mining lease for its Honeymoon project in the same region as Beverley as a clear-cut sign that the state wanted to upend current ALP policy.

Rann also said today that the expansion of BHP Billiton's Olympic Dam mine would see uranium output rise from 4,000 tonnes per annum to 15,000 tpa - more than Canada's entire production. Though the current policy would not prevent Olympic Dam's expansion it "stands in the way of the further development of SA's potential."

Rann said that in February there were 166 mineral exploration licences for uranium in SA and a further 105 applications for licences.

There were 60 companies and individuals holding uranium licences, including Heathgate Resources, SXR Uranium One, PepinNini Minerals, Curnamona Energy and Marathon Resources.

Rann said that subject to Alliance and Quasar board approvals the Four Mile joint venture is planning to submit a mining lease application for development by the end of this year for development of "a major mine."

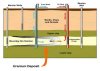

Alliance, as the public company on the Australian Stock Exchange, gave no indication of the growing resource at Four Mile which has two tandem roll front-style deposits that have given many high grade hits, particularly from intensive exploration on the most advanced Four Mile West Zone.

At last year's Broken Hill Exploration Initiative a paper was made available on research by the Lonsec group - that provides a service to Alliance - that placed Four Mile as already ahead of other Australian uranium deposits -- Yeelirrie, Valhalla and Kintyre, in grade terms, and the now maturing Ranger uranium mine for Energy Resources of Australia Ltd in the NT.

Ranger has performed well with a healthy grade of U3O8 of 0.16% but Lonsec considers Four Mile could well be 0.26% U3O8.

Four Mile, carrying the name of a nearby creek, is in the shadow of the North Flinders, where into the ranges Quasar also holds significant copper discoveries and there are other major uranium prospects, including Marathon's Mount Gee.

The Lonsec figures, based on Four Mile drilling to mid 2006, were estimated more on North America's broader resource interpretation than Australia's more stringent JORC Code. Four Mile Hill is being further drilled to initially get up to a JORC Code inferred resource. (Lonsec cites a "potential" resource in the East and West zones of 20.5 million tonnes grading 0.26% U3O8 for a contained 116M pounds). Drilling has focused on the Lower Roll Front with mineralisation to that time extending to between 160-180 metres depth in a broad sheet of sand system, as compared with the more sinuous channels of Beverley's lower grade mineralization, 10 kilometres away.

At the Broken Hill conference Quasar's exploration manager Geoff McConachy told this writer that Four Mile may well open up a new geological play for uranium in the Lake Frome-North Flinders region.

Grades picked up from the more intense drilling on the Four Mile West zone included 11m @ 0.8% U3O8, 9m @ 1.66% U3O8. 9.5m @ 0.97% and 3m @ 2.1% U3O8.

Heathgate is a subsidiary of General Atomics Group of the United States, a huge private company with uranium mining, trading and mine remediation subsidiaries in the US and the UIT group in Dresden in Germany.

As well as the Alliance JV, Heathgate has sown up joint ventures north and south of Beverley with Giralia Resources and with Paladin Resources.

http://www.mineweb.com:8080/mineweb/view/mineweb/en/page38?oid=18953&sn=Detail

Australian uranium again impacted by political swings and roundabouts

Conflicting policies have been announced by the State Premiers of Queensland and South Australia on uranium mining in their jurisdictions.

Author: Ross Louthean

Posted: Monday , 02 Apr 2007

PERTH -

The Australian share market's view of political certainty for sweeping change by the Australian Labor Party (ALP) to its restrictive policy on uranium mining and exports took one step backwards and another forward today with comments by Labor Premiers in the key states of Queensland and South Australia.

This comes within less than four weeks before the national conference of the ALP meets to discuss major policy issues including whether the No New Mines policy would be changed to a more open policy on allowing new mines. Labor controls all state governments and has its Federal Leader Kevin Rudd leading Prime Minister John Howard in opinion polls, and Rudd will be leading the push for change.

Political observers had been seeing the party rump falling in line with Rudd's wish and that included Queensland Premier Peter Beattie. However, today Beattie told an ABC News programme that if conference gave the states discretion on this issue, then he would not allow uranium mining.

Clearly, the anti uranium hardliners in the party will be pushing for discretionary powers as a second fall back line and, if so, then Queensland with some of Australia's huge undeveloped deposits would close its doors, along with Western Australia where Premier Alan Carpenter has been saying for some time there would be no uranium mines under his reign.

The Northern Territory, where Chief Minister Clare Martin made it clear at her re-election last year that she would ban new uranium mines, is in a political conundrum for the Federal Liberal government made it clear that it was a dependency of Canberra which wants new mines, and that would happen.

A pro development policy may be invoked for the NT even if Rudd beats Howard at the next Federal election, however, one day in the life of Australian uranium politics is proving right now to be a variation on the next.

Beattie's comments will spook many investors in Queensland uranium stocks, including Summit Resources which owns 100% of several deposits near Mount Isa and owns other key deposits 50/50 with Paladin Resources which has mounted a hostile takeover.

However, the immediate response on he tAustralian Stock Exchange trading today was a minor slip in Summit's price by $A0.13 to the $A4.80 range.

In contrast to Queensland, the pro mining state of South Australia which hosts two of the country's uranium mines - BHP Billiton's Olympic Dam and Heathgate Resources' Beverley - made it clear it would be supporting an end to the ALP's current policy and development of one of the country's exciting new discoveries. This is Four Mile, near Beverley, where Heathgate's search arm Quasar Resources is earning 70% from junior Alliance Resources.

SA Premier Mike Rann, speaking from Chile, released today a statement to coincide with Alliance-Quasar's announcement of more drilling leading to a scoping and pre-feasibility study.

Last year SA's Mines Minister Paul Holloway told this writer that it had already granted SXR Uranium One a mining lease for its Honeymoon project in the same region as Beverley as a clear-cut sign that the state wanted to upend current ALP policy.

Rann also said today that the expansion of BHP Billiton's Olympic Dam mine would see uranium output rise from 4,000 tonnes per annum to 15,000 tpa - more than Canada's entire production. Though the current policy would not prevent Olympic Dam's expansion it "stands in the way of the further development of SA's potential."

Rann said that in February there were 166 mineral exploration licences for uranium in SA and a further 105 applications for licences.

There were 60 companies and individuals holding uranium licences, including Heathgate Resources, SXR Uranium One, PepinNini Minerals, Curnamona Energy and Marathon Resources.

Rann said that subject to Alliance and Quasar board approvals the Four Mile joint venture is planning to submit a mining lease application for development by the end of this year for development of "a major mine."

Alliance, as the public company on the Australian Stock Exchange, gave no indication of the growing resource at Four Mile which has two tandem roll front-style deposits that have given many high grade hits, particularly from intensive exploration on the most advanced Four Mile West Zone.

At last year's Broken Hill Exploration Initiative a paper was made available on research by the Lonsec group - that provides a service to Alliance - that placed Four Mile as already ahead of other Australian uranium deposits -- Yeelirrie, Valhalla and Kintyre, in grade terms, and the now maturing Ranger uranium mine for Energy Resources of Australia Ltd in the NT.

Ranger has performed well with a healthy grade of U3O8 of 0.16% but Lonsec considers Four Mile could well be 0.26% U3O8.

Four Mile, carrying the name of a nearby creek, is in the shadow of the North Flinders, where into the ranges Quasar also holds significant copper discoveries and there are other major uranium prospects, including Marathon's Mount Gee.

The Lonsec figures, based on Four Mile drilling to mid 2006, were estimated more on North America's broader resource interpretation than Australia's more stringent JORC Code. Four Mile Hill is being further drilled to initially get up to a JORC Code inferred resource. (Lonsec cites a "potential" resource in the East and West zones of 20.5 million tonnes grading 0.26% U3O8 for a contained 116M pounds). Drilling has focused on the Lower Roll Front with mineralisation to that time extending to between 160-180 metres depth in a broad sheet of sand system, as compared with the more sinuous channels of Beverley's lower grade mineralization, 10 kilometres away.

At the Broken Hill conference Quasar's exploration manager Geoff McConachy told this writer that Four Mile may well open up a new geological play for uranium in the Lake Frome-North Flinders region.

Grades picked up from the more intense drilling on the Four Mile West zone included 11m @ 0.8% U3O8, 9m @ 1.66% U3O8. 9.5m @ 0.97% and 3m @ 2.1% U3O8.

Heathgate is a subsidiary of General Atomics Group of the United States, a huge private company with uranium mining, trading and mine remediation subsidiaries in the US and the UIT group in Dresden in Germany.

As well as the Alliance JV, Heathgate has sown up joint ventures north and south of Beverley with Giralia Resources and with Paladin Resources.

http://www.mineweb.com:8080/mineweb/view/mineweb/en/page38?oid=18953&sn=Detail