Lab techs must have brought up couple of days back

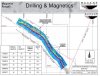

Katanning Project has produced high quality iron and vanadium concentrates:

Mine Hill concentrate: 62.8% Iron & 1.89% vanadium pentoxide

Red Hill concentrate: 61.9% Iron & 1.94% vanadium pentoxide

We're right next to MGX with market cap of $24mil. At all time high of 30c, blue skys ahead!

Katanning Project has produced high quality iron and vanadium concentrates:

Mine Hill concentrate: 62.8% Iron & 1.89% vanadium pentoxide

Red Hill concentrate: 61.9% Iron & 1.94% vanadium pentoxide

We're right next to MGX with market cap of $24mil. At all time high of 30c, blue skys ahead!