- Joined

- 4 December 2008

- Posts

- 486

- Reactions

- 281

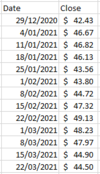

I want to import price information from Norgatedata into Excel. Mainly for record keeping. I'd like to do it directly from Excel but there doesn't appear to be an option. There are three ways I can think of.

Option 1:

Use XLQ2 to directly access the data from Excel. XLQ2 costs $300. According to the Norgate website this appears to be the only way Excel can access the data. Is this true? Is share trade tracker using XLQ2? Isn't there a way to use VBA to access the data similar to the python API?

Option 2:

Use the Python interface. If I structure my spreadsheet in a standard format, I can have Python open it, look for the codes, return the prices from Norgate, update the price fields and exit the spreadsheet. Seems like roundabout way to do a simple task. But it's free and automatic, once you've put the effort into making it work.

Option 3:

Have Excel export a list of relevant tickers. Import that list into Amibroker as a watchlist and have Amibroker run an explore to produce a list of closing prices as of the specified dates. Copy and paste that list back into Excel as a table and reference the data as required. A manual process, but in some ways the easiest method.

Does anyone have a better idea?

Option 1:

Use XLQ2 to directly access the data from Excel. XLQ2 costs $300. According to the Norgate website this appears to be the only way Excel can access the data. Is this true? Is share trade tracker using XLQ2? Isn't there a way to use VBA to access the data similar to the python API?

Option 2:

Use the Python interface. If I structure my spreadsheet in a standard format, I can have Python open it, look for the codes, return the prices from Norgate, update the price fields and exit the spreadsheet. Seems like roundabout way to do a simple task. But it's free and automatic, once you've put the effort into making it work.

Option 3:

Have Excel export a list of relevant tickers. Import that list into Amibroker as a watchlist and have Amibroker run an explore to produce a list of closing prices as of the specified dates. Copy and paste that list back into Excel as a table and reference the data as required. A manual process, but in some ways the easiest method.

Does anyone have a better idea?