Hi all, I am a novice investor and new to this site.

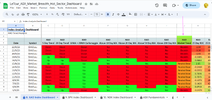

Can anyone please tell me where I can find the end of day figures for industrial stocks and (separately) mining and oil stocks ONLINE, in a similar format to the details printed in the financial pages of the daily newspapers, and in a format (such as Excel) which allows me to do calculations on the figures.

I only require the information weekly initially, and I am prepared to pay a reasonable fee if the data is not available for free.

Thanks in advance, Harvey1

Can anyone please tell me where I can find the end of day figures for industrial stocks and (separately) mining and oil stocks ONLINE, in a similar format to the details printed in the financial pages of the daily newspapers, and in a format (such as Excel) which allows me to do calculations on the figures.

I only require the information weekly initially, and I am prepared to pay a reasonable fee if the data is not available for free.

Thanks in advance, Harvey1