You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2023 August reporting season

- Thread starter bigdog

- Start date

-

- Tags

- 2023 august reporting season

bigdog

Retired many years ago

- Joined

- 19 July 2006

- Posts

- 8,157

- Reactions

- 5,548

7 More today

| Ardent Leisure (ALC) | ||

| Australian Clinical Labs (ACL) | ||

| Australian Vintage (AVG) | ||

| Boart Longyear (BLY) | ||

| Humm (HUM) | ||

| Michael Hill (MHI) | ||

| Pexa (PXA) |

Dona Ferentes

Abrió la caja, vio al gatito, y sonrió

- Joined

- 11 January 2016

- Posts

- 15,617

- Reactions

- 21,254

Dona Ferentes

Abrió la caja, vio al gatito, y sonrió

- Joined

- 11 January 2016

- Posts

- 15,617

- Reactions

- 21,254

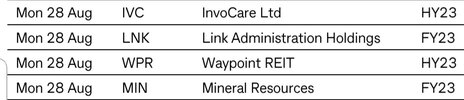

Reporting on Tuesday:

Adbri (ABC)

Cooper Energy (COE)

Johns Lyng Group (JLG)

Mineral Resources (MIN)

Praemium (PPE)

Resimac (RMC)

Star Entertainment (SGR)

Superloop (SLC)

Tyro Payments (TYR)

Zip Co (ZIP)

Adbri (ABC)

Cooper Energy (COE)

Johns Lyng Group (JLG)

Mineral Resources (MIN)

Praemium (PPE)

Resimac (RMC)

Star Entertainment (SGR)

Superloop (SLC)

Tyro Payments (TYR)

Zip Co (ZIP)

Last edited:

I only have 3 on my list for today, Dona....well done on yours.

Was wondering what happened to MIN yesterday when there were no 'fillers' Down yesterday $1.22, interesting to see what happens with sp today considering materials were green last night.

Was wondering what happened to MIN yesterday when there were no 'fillers' Down yesterday $1.22, interesting to see what happens with sp today considering materials were green last night.

Dona Ferentes

Abrió la caja, vio al gatito, y sonrió

- Joined

- 11 January 2016

- Posts

- 15,617

- Reactions

- 21,254

today's...

Auswide Bank (ABA)

Brambles (BXB)

City Chic (CCX)

Healius (HLS)

Flight Centre (FLT)

Kelsian (KLS)

Prospa (PGL)

Regional Express (REX)

and tomorrow, for the end of the month, 31st, rounding off the season, some are:

AMA Group (AMA)

Atlas Arteria (ALX)

Cromwell (CMW)

Harvey Norman (HVN)

IGO (IGO)

Sandfire (SFR)

Auswide Bank (ABA)

Brambles (BXB)

City Chic (CCX)

Healius (HLS)

Flight Centre (FLT)

Kelsian (KLS)

Prospa (PGL)

Regional Express (REX)

and tomorrow, for the end of the month, 31st, rounding off the season, some are:

AMA Group (AMA)

Atlas Arteria (ALX)

Cromwell (CMW)

Harvey Norman (HVN)

IGO (IGO)

Sandfire (SFR)

Dona Ferentes

Abrió la caja, vio al gatito, y sonrió

- Joined

- 11 January 2016

- Posts

- 15,617

- Reactions

- 21,254

post mortem time.

.

"As the curtains close on this season’s corporate reporting, it’s evident that investors have been on quite the rollercoaster ride. Daily stock swings exceeding 20 per cent became the new normal, regardless of a company’s size.

The culprits to this volatility are a lack of investor confidence and uncertain outlooks, further exacerbated by thin trading liquidity.

However, amid the turmoil, there was a glimmer of hope: our economy showcased remarkable resilience. The reporting season played out as expected, with corporations delivering robust revenues despite grappling with heightened operational costs.

Yet, what caught many off guard was the extent of analysts’ miscalculations on interest payment expectations for the upcoming year. Even sectors renowned for their precise forecasting, like Australian real estate investment trusts, or AREITs, witnessed substantial earnings downgrades.

In the grand scheme of things, we’ve observed a collective 2 per cent downgrade in financial year 2024 earnings among ASX 200 companies, making this reporting season one of the most challenging in recent memory.

.

"As the curtains close on this season’s corporate reporting, it’s evident that investors have been on quite the rollercoaster ride. Daily stock swings exceeding 20 per cent became the new normal, regardless of a company’s size.

The culprits to this volatility are a lack of investor confidence and uncertain outlooks, further exacerbated by thin trading liquidity.

However, amid the turmoil, there was a glimmer of hope: our economy showcased remarkable resilience. The reporting season played out as expected, with corporations delivering robust revenues despite grappling with heightened operational costs.

Yet, what caught many off guard was the extent of analysts’ miscalculations on interest payment expectations for the upcoming year. Even sectors renowned for their precise forecasting, like Australian real estate investment trusts, or AREITs, witnessed substantial earnings downgrades.

In the grand scheme of things, we’ve observed a collective 2 per cent downgrade in financial year 2024 earnings among ASX 200 companies, making this reporting season one of the most challenging in recent memory.

Dona Ferentes

Abrió la caja, vio al gatito, y sonrió

- Joined

- 11 January 2016

- Posts

- 15,617

- Reactions

- 21,254

PM2 ... higher dividends > 20 per cent

.

IGO Ltd . The final dividend will be 1,100% higher than last year at 60 cents per share, comprising a 44-cent final dividend and a 16-cent special dividend. 278 per cent increase in NPAT of $1.53 billion.

Insurance Australia Group Ltd reported a 140 per cent increase in NPAT to $832 million. Investors to get a final dividend of 9 cents per share, up 80%.

AGL Energy Limited will pay a 130% higher final dividend of 23 cents per share. The company benefitted from higher energy prices with a 25 per cent rise in NPAT.

Super Retail Group Ltd declared a final dividend of 44 cents per share plus a special dividend of 25 cents per share, a 60% rise, following record sales and 11 per cent lift in NPAT $263 million in FY23.

Suncorp Group Ltd raised its final dividend by 59% to 27 cents per share. It reported an NPAT of $1.15 billion, up from $681 million in FY22.

Pro Medicus Ltd declared a final dividend of 17 cents, up 36% on FY22, with a 36.5% increase in NPAT to $60.5 million.

NIB Holdings Ltd raised its final dividend by 36% to 15 cents per share. It reported a 43 per cent increase in NPAT to $191 million.

Carsales.Com Ltd will pay a final dividend of 32.5 cents per share, up 33% on FY22, from a 43% increase in adjusted NPAT to $278.2 million.

Bendigo and Adelaide Bank Ltd raised its final dividend by 21% to 32 cents per share after reporting a 14 per cent increase in total income.

Cochlear Limited dividend up 21% to $1.75 per share. Record revenue and a 10% rise in underlying net profit to $305 million.

Origin Energy Ltd shares will pay a 21% boosted dividend of 20 cents per share, with the final dividend this time around fully franked, and based on an 84 per cent lift in NPAT to $747 million in FY23.

Transurban Group upped its final dividend by 21% to 31.5 cents per share, after a record proportional toll revenue of $3.3 billion, up 26% from FY22.

.

IGO Ltd . The final dividend will be 1,100% higher than last year at 60 cents per share, comprising a 44-cent final dividend and a 16-cent special dividend. 278 per cent increase in NPAT of $1.53 billion.

Insurance Australia Group Ltd reported a 140 per cent increase in NPAT to $832 million. Investors to get a final dividend of 9 cents per share, up 80%.

AGL Energy Limited will pay a 130% higher final dividend of 23 cents per share. The company benefitted from higher energy prices with a 25 per cent rise in NPAT.

Super Retail Group Ltd declared a final dividend of 44 cents per share plus a special dividend of 25 cents per share, a 60% rise, following record sales and 11 per cent lift in NPAT $263 million in FY23.

Suncorp Group Ltd raised its final dividend by 59% to 27 cents per share. It reported an NPAT of $1.15 billion, up from $681 million in FY22.

Pro Medicus Ltd declared a final dividend of 17 cents, up 36% on FY22, with a 36.5% increase in NPAT to $60.5 million.

NIB Holdings Ltd raised its final dividend by 36% to 15 cents per share. It reported a 43 per cent increase in NPAT to $191 million.

Carsales.Com Ltd will pay a final dividend of 32.5 cents per share, up 33% on FY22, from a 43% increase in adjusted NPAT to $278.2 million.

Bendigo and Adelaide Bank Ltd raised its final dividend by 21% to 32 cents per share after reporting a 14 per cent increase in total income.

Cochlear Limited dividend up 21% to $1.75 per share. Record revenue and a 10% rise in underlying net profit to $305 million.

Origin Energy Ltd shares will pay a 21% boosted dividend of 20 cents per share, with the final dividend this time around fully franked, and based on an 84 per cent lift in NPAT to $747 million in FY23.

Transurban Group upped its final dividend by 21% to 31.5 cents per share, after a record proportional toll revenue of $3.3 billion, up 26% from FY22.

Dona Ferentes

Abrió la caja, vio al gatito, y sonrió

- Joined

- 11 January 2016

- Posts

- 15,617

- Reactions

- 21,254

Companies yet to report for 31 July include Myer and Premier Investments, Washington H Soul Pattinson, New Hope and Brickworks. Companies finalising their books 30 September include major banks like ANZ, NAB, Westpac, and Macquarie, along with Incitec Pivot, Orica, Nufarm, Elders and GrainCorp.

....

Like all years, it's a bit of a curate's egg; it seems that the June season surpassed initial fears, though expectations were adjusted downward due to cautious corporate guidance. This is evident in the adjustments to estimates for the 2023-2024 period.

According to AMP's Chief Economist, Shane Oliver, upside and downside surprises have been nearly balanced, with around 36% surprising on the upside (below the average of 43%) and 34% surprising on the downside (higher than the average of 26%).

Only 58% of companies experienced earnings growth compared to the previous year, lower than the average of 63%. Additionally, only 43% increased dividends from the previous year, below the average of 58%, indicating a degree of caution for the upcoming financial year.

Some 51% of companies saw their share prices outperform the market on their reporting day. Although better than the February reporting season, this falls slightly under the average of 53%.

Key themes emerging from the earnings results include persistent cost pressures, building material companies benefiting from robust activity but cautioning about a potential slowdown, insurers achieving margin improvement at the cost of customers through significant premium hikes, and a resilience among home borrowers in keeping up with payments despite pending rate hikes. Corporate guidance has generally been cautious, with more negative than positive outlooks. Retailers, in particular, are signaling tougher conditions and observing better-off customers turning to discount stores for value

.

.

.... and that's a wrap.

....

Like all years, it's a bit of a curate's egg; it seems that the June season surpassed initial fears, though expectations were adjusted downward due to cautious corporate guidance. This is evident in the adjustments to estimates for the 2023-2024 period.

According to AMP's Chief Economist, Shane Oliver, upside and downside surprises have been nearly balanced, with around 36% surprising on the upside (below the average of 43%) and 34% surprising on the downside (higher than the average of 26%).

Only 58% of companies experienced earnings growth compared to the previous year, lower than the average of 63%. Additionally, only 43% increased dividends from the previous year, below the average of 58%, indicating a degree of caution for the upcoming financial year.

Some 51% of companies saw their share prices outperform the market on their reporting day. Although better than the February reporting season, this falls slightly under the average of 53%.

Key themes emerging from the earnings results include persistent cost pressures, building material companies benefiting from robust activity but cautioning about a potential slowdown, insurers achieving margin improvement at the cost of customers through significant premium hikes, and a resilience among home borrowers in keeping up with payments despite pending rate hikes. Corporate guidance has generally been cautious, with more negative than positive outlooks. Retailers, in particular, are signaling tougher conditions and observing better-off customers turning to discount stores for value

.

.

.... and that's a wrap.

And at a glance, the ones in red...far right hand column...

bigdog

Retired many years ago

- Joined

- 19 July 2006

- Posts

- 8,157

- Reactions

- 5,548

37 stocks were covered as part of Livewire's reporting season coverage (and only four were "sells")

Missed some of our reporting season coverage? Have no fear - this article will do the heavy lifting for you.

37 stocks were covered as part of Livewire's reporting season coverage (and only four were "sells")

Missed some of our reporting season coverage? Have no fear - this article will do the heavy lifting for you.

You could hear a collective sigh of relief last week as the bell rang on the August reporting season. Over the month, Livewire's content editors worked tirelessly with our contributors to cover 37 stocks, focusing on the companies that readers, like you, have told us you care about.

Interestingly, of the 37 stocks covered, 12 were rated as "buys". Meanwhile, 21 received "hold" ratings and only four were rated as "sells". That's pretty incredible considering how dire many predicted this reporting season would be.

Livewire also broke new ground by reaching out to seven CEOs of listed companies for an insider's look at their latest reports and the outlook on their various sectors.

In this wire, I'll provide a summary of our coverage so you can find the pieces that you care about with ease. I hope you enjoyed reading this content throughout August as much as we did producing it.

You could hear a collective sigh of relief last week as the bell rang on the August reporting season. Over the month, Livewire's content editors worked tirelessly with our contributors to cover 37 stocks, focusing on the companies that readers, like you, have told us you care about.

Interestingly, of the 37 stocks covered, 12 were rated as "buys". Meanwhile, 21 received "hold" ratings and only four were rated as "sells". That's pretty incredible considering how dire many predicted this reporting season would be.

Livewire also broke new ground by reaching out to seven CEOs of listed companies for an insider's look at their latest reports and the outlook on their various sectors.

In this wire, I'll provide a summary of our coverage so you can find the pieces that you care about with ease. I hope you enjoyed reading this content throughout August as much as we did producing it.

The BUYS

- Sandfire Resources (ASX: SFR)

- Commonwealth Bank (ASX: CBA)

- QBE Insurance (ASX: QBE)

- AMP (ASX: AMP)

- Goodman Group (ASX: GMG)

- Sonic Healthcare (ASX: SHL)

- Woolworths (ASX: WOW)

- Santos (ASX: STO)

- Hansen Technologies (ASX: HSN)

- Whitehaven Coal (ASX: WHC)

- Pilbara Minerals (ASX: PLS)

- Medibank Private (ASX: MPL)

The HOLDS

- AGL Energy (ASX: AGL)

- REA Group (ASX: REA)

- CSL Ltd (ASX: CSL)

- Pro Medicus (ASX: PME)

- Endeavour Group (ASX: EDV)

- Telstra (ASX: TLS)

- Beacon Lighting (ASX: BLX)

- Insurance Australia Group (ASX: IAG)

- Allkem (ASX: AKE)

- BHP (ASX: BHP)

- Megaport (ASX: MP1)

- Arafura Rare Earths (ASX: ARU)

- Coles (ASX: COL)

- Woodside Energy Group (ASX: WDS)

- PSC Insurance (ASX: PSI)

- South32 (ASX: S32)

- Wesfarmers (ASX: WES)

- Mineral Resources (ASX: MIN)

- IGO (ASX: IGO)

- Ramsay Health Care (ASX: RHC)

- Origin Energy (ASX: ORG)

The SELLS

- Newcrest Mining (ASX: NCM)

- Fortescue Metals Group (ASX: FMG)

- Qantas (ASX: QAN)

- Flight Centre (ASX: FLT)

Livewire's C-Suite Interviews

- Evolution Mining: 3 catalysts that could put some heat into the unloved gold sector

- Worley: How Worley is "firing on all cylinders" according to CFO Tiernan O'Rourke

- Ramsay Health Care: This CEO's laser focus is on paying down debt and creating a leaner business

- Woodside: Woodside CEO Meg O'Neill talks record earnings, the dividend outlook and union tensions

- Aussie Broadband: Aussie Broadband's Phillip Britt on the telco's plans to take on the incumbents

- NEXTDC: NEXTDC's Craig Scroggie is spending $1bn on an AI-fuelled future

- Adbri: This industrial company returned 34% in 2023, and it's swimming in product demand

Rudi's Reporting Season Monitor

According to FNArena's reporting season monitor, 29.6% of stocks beat expectations this reporting season, while 42.7% were in line, and 27.7% of companies fell short of analysts' earnings predictions. You can check out the final report below:

- Joined

- 20 July 2021

- Posts

- 11,326

- Reactions

- 15,712

Bank reporting season: which ones get the gold stars?

Bank reporting season: which ones get the gold stars?

The banks have reported results and it's a mixed picture of reduced margins from increased deposit competition, yet low bad debts and healthy capital positions. Here's a look at which banks stood out and which ones didn't.

i hold MQG ( 'free-carried' ) and a trivial amount of WBC

vampire-kangaroo is it , maybe they should expand that to Teflon-coated vampire kangaroo

I'm piggybacking onto this old thread....the February Reporting Season Calendar for 2024...if anyone wants to start a new thread, please feel free to do so, thank you. (I can't find the Feb Reporting Season, assuming it hasn't been posted?)

- Joined

- 8 March 2007

- Posts

- 2,665

- Reactions

- 3,636

The title makes no sence and Subject matter even Less-----IMHO