This company keeps on keeping on, and they have just been awarded an undergrounding contract from energy aust sydney metro area for directional drilling and power distribution (vide ann 2/04/07)

a service provider in a specialised market

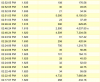

Some profit taking at $1.95 I think, now regaining.

IMHO

DYOR

a service provider in a specialised market

Some profit taking at $1.95 I think, now regaining.

IMHO

DYOR