- Joined

- 9 May 2006

- Posts

- 421

- Reactions

- 0

I am still waiting to hear back from GCR re whether share issue is pro rata or up to $5,000 per shareholder.

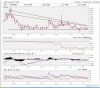

Judgeing by the share price movement others are thinking the same thing.

If the later as it seems, and all 2855 shareholders take up their full entitlement of 133,333 shares the no of shares will rise from 540.5m to 921.165m and not considering any extra value for the extra cash, based on the market cap prior announcement @ 4c/ share, the share value post issue looks more like 2.3c/ share.

The issue is up to $5,000 per shareholder. The chances of all holders taking up their full entitlment is virtually non existant. However, if that were to occur the company would raise $14mil and I imagine the board would be over the moon.

The more likely scenario is that around 50mil to 100mil shares will be issued raising around $2mil to $4mil which will be going into the planned drilling program.

Not currently holding but on my watchlist.