Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,715

- Reactions

- 22,801

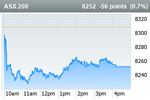

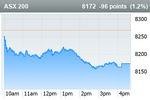

futures are down 45 points, or 0.5 per cent.

Companies reporting include Domino’s Pizza, Nine Entertainment, Platinum Asset Management, G8 Education and Woodside Energy.

Companies reporting include Domino’s Pizza, Nine Entertainment, Platinum Asset Management, G8 Education and Woodside Energy.

- AUD -0.1% to US63.53¢

- Bitcoin -1.5% to $US94,265

- Gold +0.5% to $US2949.82 an ounce

- Brent oil +0.3% to $US74.66 a barrel

- Iron ore -0.2% to $US108.30 a tonne

- 10-year yield: US 4.40%, Australia 4.43%