Hi all

I ask this question of indicators when to sell because bugger if i can get it right. I have held after a run only to see the price plummet down etc

I also have had a run and sold on retrace just in case it would also plummet only to rebound and move higher

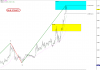

At the moment one of my stocks is BPT just had a strong run with it but still just under what i bought at, now is it going to go back down or continue, what should i be looking for.

Regards

SG

I ask this question of indicators when to sell because bugger if i can get it right. I have held after a run only to see the price plummet down etc

I also have had a run and sold on retrace just in case it would also plummet only to rebound and move higher

At the moment one of my stocks is BPT just had a strong run with it but still just under what i bought at, now is it going to go back down or continue, what should i be looking for.

Regards

SG