Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

Wysiwyg,

i suggest you go here to learn about medianlines..

there is a lot to learn on this site, if you wish to take your time,

the world can be your oyster..

one of the best things of trading is the learning process, it is like an adventure,

so enjoy the ride, the markets are always there ..your money might not..

so learn your trade well

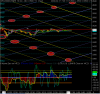

my chart is my design..but it comes from medianlines

http://www.marketgeometry.com

have a great day, and take care

ac

Thanks acouch.I checked the site out, the book about Alan Andrews Pitchforks and Tim Morges Website which claims this ...

These techniques were used by Alan Andrews during the 1929 crash to make more than US $500 million [adjusted for inflation, that’s well over US $12 billion!]. We are facing the same market conditions now. Come take a Market Maps Seminar and let me teach you how to make money trading while the majority of the traders out there are struggling. The next seminar will be held Saturday January 17th, 2009 at 9 am CST via the internet.

Another path, another technique, more learning.An ongoing process of which I`ve been building 100`s of hours over the last 6 months.

Thanks and good luck with your way.