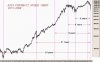

I've posted this before, but a chart taken from Bob Prechter's book Conquer The Crash. A bit sketchy I'm afraid, due to the manner of its reproduction. The book was first published in 2002, and this is from a 2007 reprint, but I don't think the chart has been added to since the original release.

GP

Prechter is known for changing his counts in different versions of his books so as to not look a fool.

Editions 1 and 2 of one of his books has very different counts compared to later prints of the book. The initial counts were proven to be very, very wrong.