Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,018

- Reactions

- 11,005

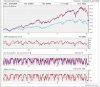

Re: XAO Analysis

I'd be intersted to see some stats on if you bought the index at the start, or 'bottom' of a crash, on how well off you'd be.

I have some spare beer money right now....

I'd be intersted to see some stats on if you bought the index at the start, or 'bottom' of a crash, on how well off you'd be.

I have some spare beer money right now....