springhill

Make the drill work for YOU

- Joined

- 20 June 2007

- Posts

- 2,555

- Reactions

- 11

For those looking for a spec play here is one worth looking at, I think.

Laconia have an interesting exploration schedule this quarter, including drilling for gold at Kookynie, in the eastern goldfields. Area targetted has high grade historic results, at a small depth range, though near surface.

The Mooletar Project has an Exploration Target of 216-264Mt @ 30-35% Fe.

Most intersetingly of all is the 701 mile Project, looking for gold and base metals. The real interest here is in the REE potential of this area. Anything that turns up significant REE rockets, so may be worth a punt.

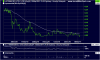

LCR has the capital structure i look for in a company, but i have another fish to fry ATM, so thought to highlight it for others that may be interested. Is very near its 12 mth low and look to be careful with the cash they have in bank.

Current SP 8.5c

MC $5m

Shares on Issue 70m

12mth High/Low 7.6/17c

Cash at Hand $3.1m

Expenses this Quarter $300k

Laconia have an interesting exploration schedule this quarter, including drilling for gold at Kookynie, in the eastern goldfields. Area targetted has high grade historic results, at a small depth range, though near surface.

The Mooletar Project has an Exploration Target of 216-264Mt @ 30-35% Fe.

Most intersetingly of all is the 701 mile Project, looking for gold and base metals. The real interest here is in the REE potential of this area. Anything that turns up significant REE rockets, so may be worth a punt.

LCR has the capital structure i look for in a company, but i have another fish to fry ATM, so thought to highlight it for others that may be interested. Is very near its 12 mth low and look to be careful with the cash they have in bank.

Current SP 8.5c

MC $5m

Shares on Issue 70m

12mth High/Low 7.6/17c

Cash at Hand $3.1m

Expenses this Quarter $300k