Hi there,

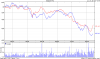

Assume there is a basket of stocks with many having gone down significantly in value since the time they were purchased, say in 2006-2007.

Assume some of the portfolio is in small stocks and another part is in index type funds.

Now, I'm thinking about selling these two types of investment in the not to distant future, at a loss and re-invest into large caps, possibly financial stocks. My reasoning is that as financial stocks have gone down the most (and may go down further) and are likely to re-bounce the fastest and the strongest. (and quicker than small caps as well as funds)

Any thoughts on this strategy?

Assume there is a basket of stocks with many having gone down significantly in value since the time they were purchased, say in 2006-2007.

Assume some of the portfolio is in small stocks and another part is in index type funds.

Now, I'm thinking about selling these two types of investment in the not to distant future, at a loss and re-invest into large caps, possibly financial stocks. My reasoning is that as financial stocks have gone down the most (and may go down further) and are likely to re-bounce the fastest and the strongest. (and quicker than small caps as well as funds)

Any thoughts on this strategy?