Where's the DOW heading today?

- Thread starter leong

- Start date

- Joined

- 28 May 2004

- Posts

- 10,924

- Reactions

- 5,492

- Joined

- 21 December 2004

- Posts

- 674

- Reactions

- 1

Re: wheres the dow heading today?

The last three days it has dropped over 200 points with a pause yesterday. I expect it to hit 10,000 soon.

The last three days it has dropped over 200 points with a pause yesterday. I expect it to hit 10,000 soon.

- Joined

- 12 April 2005

- Posts

- 842

- Reactions

- 0

Re: wheres the dow heading today?

2004 was a year to buy the dips but now maybe is a time to sell the spikes on the US markets

Its certainly been easier to pick lately from my data, indicators etc

2004 was a year to buy the dips but now maybe is a time to sell the spikes on the US markets

Its certainly been easier to pick lately from my data, indicators etc

- Joined

- 21 December 2004

- Posts

- 674

- Reactions

- 1

Re: wheres the dow heading today?

It's been dropping for the last month and a half and looking at the charts, still has a lot further to go. I'm thinking that it will break below the 10,000 mark soon. Maybe by next week.

It's been dropping for the last month and a half and looking at the charts, still has a lot further to go. I'm thinking that it will break below the 10,000 mark soon. Maybe by next week.

- Joined

- 14 February 2005

- Posts

- 15,543

- Reactions

- 18,281

Re: wheres the dow heading today?

Medium term (12+ months) I think the Dow is headed down. Short term I'm expecting a modest rise over the next two weeks IN THE ASX. The Dow may not be coming along for the ride judging by the way it's going. Very short term I think up tonight for the Dow but then I don't trade over that short a time frame so haven't put too much effort into that prediction. :goodnight

Medium term (12+ months) I think the Dow is headed down. Short term I'm expecting a modest rise over the next two weeks IN THE ASX. The Dow may not be coming along for the ride judging by the way it's going. Very short term I think up tonight for the Dow but then I don't trade over that short a time frame so haven't put too much effort into that prediction. :goodnight

- Joined

- 12 April 2005

- Posts

- 842

- Reactions

- 0

Re: wheres the dow heading today?

You actually believe the inflation figures!

Who are the people financing the US deficit, what has been suggested will happen in the near future with their exchange rate

And what impact will that have on their holdings?

Will the still be happy to lose money year on year?

Don't you think the tax cuts to the rich have driven some of the earnings there?

I would like to see the earnings of the companies that do most of their business in the US and not a lot overseas, versus the big internationals

I suspect a lot of the overseas co's. have been able to compete because of the lower dollar, if it strengthens against most of the major currencies I suspect earnings will dive

But my major issue is the still high valuations using current earnings NOT projected earnings which all the bulls will use to say the market is undervalued

If you look at historical valuations we are well on the high side

There's also the leverage of the major finance houses in the derivatives market

LTCM failed with leverage about 30 to 1, some these funds were running levearge to assets in the 40 to 1 range, while leverage to equity was over 600 to 1.

I wouldn't be surprized to see the DOW finish the year well under 10000

But we'll see what happens

Anyway here is a one year chart of the DJI

sorry you'll have to cut and paste into browser the hyperlink function doesn't like it

http://stockcharts.com/def/servlet/SharpChartv05.ServletDriver?chart=$indu,uu[w,a]dacayyay[dd][pb50!b200!f][vc60][iut!lb14!lh14,3]&r=5754]

You actually believe the inflation figures!

Who are the people financing the US deficit, what has been suggested will happen in the near future with their exchange rate

And what impact will that have on their holdings?

Will the still be happy to lose money year on year?

Don't you think the tax cuts to the rich have driven some of the earnings there?

I would like to see the earnings of the companies that do most of their business in the US and not a lot overseas, versus the big internationals

I suspect a lot of the overseas co's. have been able to compete because of the lower dollar, if it strengthens against most of the major currencies I suspect earnings will dive

But my major issue is the still high valuations using current earnings NOT projected earnings which all the bulls will use to say the market is undervalued

If you look at historical valuations we are well on the high side

There's also the leverage of the major finance houses in the derivatives market

LTCM failed with leverage about 30 to 1, some these funds were running levearge to assets in the 40 to 1 range, while leverage to equity was over 600 to 1.

I wouldn't be surprized to see the DOW finish the year well under 10000

But we'll see what happens

Anyway here is a one year chart of the DJI

sorry you'll have to cut and paste into browser the hyperlink function doesn't like it

http://stockcharts.com/def/servlet/SharpChartv05.ServletDriver?chart=$indu,uu[w,a]dacayyay[dd][pb50!b200!f][vc60][iut!lb14!lh14,3]&r=5754]

Re: wheres the dow heading today? The fed should be investigated.

There is no evidence that inflation is running rampant. One minute the market is concerned about the economy slowing and no sooner do u get a great result eg the new job figures of 274,000 then they talk about inflationary pressures. It seems that there is not a great deal that makes the market happy. I think the market is being driven by speculators and spread betters. I mean whats with the fed amendment right before the close claiming inflation was "contained". That amendment just before the close changed the entire day. I am surprised that there was no investigation. I thought it was very sus.

happy trading

There is no evidence that inflation is running rampant. One minute the market is concerned about the economy slowing and no sooner do u get a great result eg the new job figures of 274,000 then they talk about inflationary pressures. It seems that there is not a great deal that makes the market happy. I think the market is being driven by speculators and spread betters. I mean whats with the fed amendment right before the close claiming inflation was "contained". That amendment just before the close changed the entire day. I am surprised that there was no investigation. I thought it was very sus.

happy trading

- Joined

- 10 July 2004

- Posts

- 2,913

- Reactions

- 3

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,459

- Reactions

- 6,535

Re: wheres the dow heading today?

Ranging between 10 and 11000.

Directionless. Some up some down.

Really a matter of finding gems or working with the range.

Ranging between 10 and 11000.

Directionless. Some up some down.

Really a matter of finding gems or working with the range.

- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

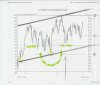

DIRECTIONLESS ?

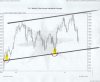

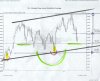

Here is a technical view of the Dow ,

and what its been up to ..............YOU BE THE JUDGE !

---------------------------------------------------------------------

1ST THE SELL OFF IN APRIL....

PRICE IS NOW CONTAINED ,

IN THIS SIMPLE RISING CHANNEL FORMATION

----------------------------------------------------------

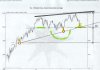

NEXT THING YOU KNOW

a ( 3 wht soldier candlestick pattern ) has formed .....

HMMMM , What next ? CAN THIS HOLD ?

STAY TUNED ...............

-----------------------------------------------------------------------

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

Here is a technical view of the Dow ,

and what its been up to ..............YOU BE THE JUDGE !

---------------------------------------------------------------------

1ST THE SELL OFF IN APRIL....

PRICE IS NOW CONTAINED ,

IN THIS SIMPLE RISING CHANNEL FORMATION

----------------------------------------------------------

NEXT THING YOU KNOW

a ( 3 wht soldier candlestick pattern ) has formed .....

HMMMM , What next ? CAN THIS HOLD ?

STAY TUNED ...............

-----------------------------------------------------------------------

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

Attachments

- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

- Joined

- 20 September 2005

- Posts

- 496

- Reactions

- 0

Tightly contracted bollingers on weekly and monthly charts suggests pressure is building and that a breakout from consolidation is on the horizon. This months price action suggests a strong bias to the upside. The 'expected' Santa Claus rally is likely to support this view.

As usual this is merely my opinion and just like everyone else I'm guessing.

Cheers

Happytrader

As usual this is merely my opinion and just like everyone else I'm guessing.

Cheers

Happytrader

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

No comments on the new DOW lows in?No final capitulation due to panicked and inexperienced investors?

7000 points out of the question?

7000 points out of the question?

- Joined

- 18 April 2007

- Posts

- 809

- Reactions

- 0

6% fall????????

- Joined

- 23 July 2008

- Posts

- 930

- Reactions

- 0

Whatever the protection team allows it fall too