- Joined

- 1 November 2007

- Posts

- 1,721

- Reactions

- 0

US wheat prices keep on rising

Thursday, 07/02/2008

US wheat futures continue to top records on very tight supplies and strong global demand.

US spring wheat March futures hit nearly US$15 on Wednesday, while winter wheat varieties were also up their limits to as high as US$10.80 a bushel.

Steve Mercer from US Wheat Associates says the world wheat market is really in 'uncharted' territory right now.

"We've entered the 2008 year with global stocks at their lowest level in 30 years, US stocks at a 60-year low", he says.

"In seven of the last 10 years, the world has used more wheat than it's produced".

Feb. 8 (Bloomberg) -- Wheat rose to a record for a third day on the Chicago Board of Trade as the U.S. forecast its lowest inventories in 60 years.

Wheat futures for March delivery rose 30 cents, or 2.8 percent, to a record $10.93 a bushel on the Chicago Board of Trade. The contract rose the 30-cent exchange limit for five straight days. The 16 percent gain this week is the biggest in history.

Ok thanks, btw are there any "wheat stocks" out there besides, AWB, GNC, etc

If you are able to buy UK-listed stocks then you can look at the ETF's from http://www.etfsecurities.com/en/securities/etfs_securities.asp

You can either buy a basket with all the grains, or pick the individual securites you want. I believe there are similar US-listed products as well.

Anyone know a good mortgage broker? I'm looking to get a loan for my next loaf of bread.

Pull up the lawn and plant wheat Chops .

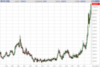

The housing ladder is dead, get on the loaf ladder before it's too late.How's this as a volatile market?

Up 3% on open, down to scratch, up 8% in 45 minutes. Insane. The really bad news for bakers and the like is that the back months are really coming along as well. The volume on the near term contracts has grown a staggering amount.

Bloomin' 'eck!

Minneapolis wheat has seen a high of ~$25!!

Can you tell me why there would be such a huge difference between the markets in the same country?

Anyway, just in case you haven't had enough of the crazies... Limit up yesterday... effectively limit down on open tonight. Absolute insanity. Enjoy:

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.