hi all

just wondering what does it imply in terms of MM intentions when you can't find too many bid/ask option spreads on a stock.

e.g. i just had a look at WPL. There's almost none available on August and Sep and very few on June and July. What does it imply? not many people are interested in this stock? what could MM be doing? i'm totally lost...

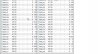

attached is a screenshot for Sep...

any comments appreciated,

cheers

just wondering what does it imply in terms of MM intentions when you can't find too many bid/ask option spreads on a stock.

e.g. i just had a look at WPL. There's almost none available on August and Sep and very few on June and July. What does it imply? not many people are interested in this stock? what could MM be doing? i'm totally lost...

attached is a screenshot for Sep...

any comments appreciated,

cheers