Having thrown away 10s of thousands of dollars in 07-08 using a buy and hold strategy I finally realised that there must be a beter way of doing things. So I bought some books, started reading this forum and invested in some software. So far this is what I have come up with, it is still a work in progress and I am interested to hear peoples opinions (Good and bad) on this possible system. So far I am only about half way through developing this. The basic premise of the strategy is that there a 3 basic market phases, bull, bear and consolidating (Trading a range), since it is impossible to accurately predict which way the market will head I plan on using 3 strategies, one for each market type and bias my trading strategy towards what the current market is. I.e If in a bull market make 60% of trades using the bull system 20% using the bear system and 20% using the consolidating system etc. Ideally I want all 3 strategies to make money in all 3 markets but this is obviously proving difficult, so at the very least I want the losses to be minimal and the system to outperform the market. The one strategy that I would currently be happy to trade is the bull market strategy. It is based on the method used by the Turtles, that is get on board a trend and sell when the trend stops. It is very simple and has me buying in when a share hits a 22 day high and selling when it hits a 22 day low (Timings still to be optimised), there are a couple more simple rules but that is basically it (Seems maybe a little too simple but that's what I like about it). No stop loss is currently used but I am experimenting with this, if used it will be a fairly loose stop based on ATR as I have found a tight stop (at about 3-4 ATR) is not letting the profits run and getting me out of the stock early. So, this is the system that I am most interested to hear peoples opinions on. Being to tight to purchase Tradesim or some other system that can do MonteCarlo backtesting I have simply used Amibroker set the PositionScore to random and run 100 tests in the date range 17/09/2001 - 11/12/2009. The results are as follows:

Testing the ASX300 (All ords gives similar results, but if I trade this system I will be looking at the ASX300 for peace of mind)

XAO increase in this time - ~52%

Smallest Return using trend system - 111% (As in just over double)

Largest Return using trend system - 4746%

Average return using trend system - 1145%

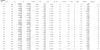

Results from a typical Backtest are as follows:

Net Profit - 988%

Annual return - 33.55%

No of trades - 377

% winners - 34%

% losers - 66%

Avg profit - 46%

Avg loss - -10%

Max trade % drawdown - 50%

Max system % drawdown - 56%

CAR - 0.6

RAR - 0.67

Risk reward ratio - 0.79

Sharpe ratio - 0.28

K ratio - .0411

Good points from this data:

Large profit increase

Relatively small number of trades

Bad points form this data:

Everything else, in particular,

Win/Loss ratio - Low, usually a bit higher (about 40/60)

Trade and system draw downs - Large, these obviously occured in 07/08 so don't worry me too much, if my system evolves as desired I would pull most of my money out and put it into my bear system (When I perfect it/get it to a reasonable level). The system still consistantly outperforms the index during this period. Stop loss will also help this.

CAR/RAR - Based on system draw downs as mentioned above.

Sharpe and K ratio - Interested to hear opinions on these.

So like I said there are some bad points to the system and it would require alot of discipline to trade but it consistently out performs the market and at the end of the day it is annualised returns that I am looking for and this provides them. Things I am still working on:

Stop loss

Position sizing - Will look to set up such that it doesn't allow me to lose more that 2% of total equity based on the 22 day low at the time of purchase or on my stop loss.

If multiple buy signals are given on any one day I will use Fundamental Analysis (Mainly looking for EPS and profit increases over the last few reporting periods, agian, still working on it).

Sorry for all the words but I have found this forum to be invaluable in setting up and testing different strategies, it has pointed me to some good resources such as the chartist and different books and also my choice of trading software in Amibroker which has been great, hence why opinions from this site will be highly valued.

Cheers,

Harro

Testing the ASX300 (All ords gives similar results, but if I trade this system I will be looking at the ASX300 for peace of mind)

XAO increase in this time - ~52%

Smallest Return using trend system - 111% (As in just over double)

Largest Return using trend system - 4746%

Average return using trend system - 1145%

Results from a typical Backtest are as follows:

Net Profit - 988%

Annual return - 33.55%

No of trades - 377

% winners - 34%

% losers - 66%

Avg profit - 46%

Avg loss - -10%

Max trade % drawdown - 50%

Max system % drawdown - 56%

CAR - 0.6

RAR - 0.67

Risk reward ratio - 0.79

Sharpe ratio - 0.28

K ratio - .0411

Good points from this data:

Large profit increase

Relatively small number of trades

Bad points form this data:

Everything else, in particular,

Win/Loss ratio - Low, usually a bit higher (about 40/60)

Trade and system draw downs - Large, these obviously occured in 07/08 so don't worry me too much, if my system evolves as desired I would pull most of my money out and put it into my bear system (When I perfect it/get it to a reasonable level). The system still consistantly outperforms the index during this period. Stop loss will also help this.

CAR/RAR - Based on system draw downs as mentioned above.

Sharpe and K ratio - Interested to hear opinions on these.

So like I said there are some bad points to the system and it would require alot of discipline to trade but it consistently out performs the market and at the end of the day it is annualised returns that I am looking for and this provides them. Things I am still working on:

Stop loss

Position sizing - Will look to set up such that it doesn't allow me to lose more that 2% of total equity based on the 22 day low at the time of purchase or on my stop loss.

If multiple buy signals are given on any one day I will use Fundamental Analysis (Mainly looking for EPS and profit increases over the last few reporting periods, agian, still working on it).

Sorry for all the words but I have found this forum to be invaluable in setting up and testing different strategies, it has pointed me to some good resources such as the chartist and different books and also my choice of trading software in Amibroker which has been great, hence why opinions from this site will be highly valued.

Cheers,

Harro