- Joined

- 4 March 2009

- Posts

- 16

- Reactions

- 0

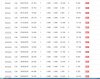

How on earth do people choose an installment warrant out of the long list?

For instance I'm looking at Woodside Petroleum (WPL) and there's dozens of self funding/installment/mini all with different expiry dates strike prices and so on. Is there a table or calculator or something to compare the different products? I assume different providers price their products cheaper/dearer.

Cheers

For instance I'm looking at Woodside Petroleum (WPL) and there's dozens of self funding/installment/mini all with different expiry dates strike prices and so on. Is there a table or calculator or something to compare the different products? I assume different providers price their products cheaper/dearer.

Cheers